Long-term Financing - PowerPoint PPT Presentation

Title:

Long-term Financing

Description:

Title: Long-term Financing Author: Miranda Lam Detzler Last modified by: Jacoby Created Date: 10/29/1996 6:45:12 PM Document presentation format: On-screen Show – PowerPoint PPT presentation

Number of Views:55

Avg rating:3.0/5.0

Title: Long-term Financing

1

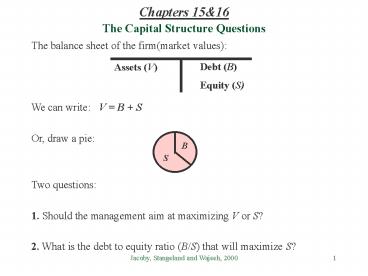

Chapters 1516

The Capital Structure Questions

The balance sheet of the firm(market

values) We can write V B S Or, draw a

pie Two questions 1. Should the management

aim at maximizing V or S? 2. What is the debt

to equity ratio (B/S) that will maximize S?

Debt (B) Equity (S)

Assets (V)

B

S

2

Is There An Optimal Capital Structure?

- Modigliani Miller (MM) Proposition I (No Taxes)

- Firm value is not affected by financial

leverage - VL VU

- MM assume (among other things)

- No risk of default

- Perpetual Cash Flows

- Firms and investors can borrow/lend at the same

rate - No taxes

3

- Proving MM Proposition I (No Taxes)

- Consider two firms, identical in every way except

that one is levered and the other is all equity

(unlevered) - Unlevered Levered

- Assets VU 1,000,000 VL ?

- Equity SU 1,000,000 SL ?

- Debt BU 0 BL 400,000

- Cost of Debt rB 5

- Recall Firms and investors can borrow/lend at

the same rate, and there are no taxes - The (uncertain) dollar return on the firms

assets is given by Y

4

Consider the following two investment

strategies Strategy A Dollar

Investment Dollar Return Buy 10 of SL 0.1SL

0.1(VL - BL) 0.1(Y - rBBL)

0.1(Y -

0.05400,000) Total CF from A 0.1(VL - BL)

0.1Y - 2,000 Strategy B

Dollar Investment Dollar Return 1) Buy 10 of

VU 0.1VU 0.1Y 2) Borrow 10 of BL

- 0.1BL - 0.1rBBL - 0.1

0.05400,000

- 2,000 Total CF

from B 0.1(VU - BL) 0.1Y -

2,000 Since the dollar return from A and B is

identical, the initial cost of both strategies

must be identical, thus 0.1(VL - BL) 0.1(VU -

BL), and VL VU MM Proposition I (No

Taxes) Firm value is not affected by leverage

(VL VU )

5

The Value of a Levered Firm UnderMM Proposition

I with No Corporate Taxes

Value ofthe firm(VL )

VL VU

VU

Debt-equity ratio (B/S)

6

MM Proposition II (No Taxes) The cost of equity

and financial leverage A. Because of Prop. I,

the WACC must be constant. With no taxes, WACC

rU (S/A) rS (B/A) rB, where A S

B where rU is the constant return on the firms

assets B. Solve for rS to get MM Prop. II (No

Taxes) rS rU (rU - rB) (B/S) Cost of

equity has two parts 1. rU and business

risk the risk inherent in the firms

operations (beta of assets) 2. B/S and

financial risk extra risk from using debt

financing

7

The Cost of Equity, the Cost of Debt, and the

Weighted Average Cost of Capital MM Proposition

II with No Corporate Taxes

Cost of capital

rS rU (rU rB) x (B/S)

WACC rU

rB

Debt-equity ratio (B/S)

8

Debt, Taxes, and Firm Value

- The interest tax shield and firm value

- For simplicity (1) perpetual cash flows (2) no

depreciation (3) no fixed asset or NWC spending - A firm is considering going from zero debt to

400 at 10 - Firm U Firm L (unlevered) (levered)

- EBIT 200 200

- Interest 0 40

- Tax (40) 80 64

- Net income 120 96

- Cash flow from

- assets (EBIT-Taxes) 120 136

- Tax saving 16 0.4 40 TC rB B

16

9

Debt, Taxes, and Firm Value (concluded)

- Whats the link between debt and firm value?

- Since interest creates a tax deduction,

borrowing creates an interest tax shield. Its

value is added to the value of the firm. - PV(perpetual tax savings) 16/0.1 160

- (TC rB B)/rB TC B

- MM Proposition I (with taxes)

- VL VU TC B

10

The Value of a Levered Firm UnderMM Proposition

I with Corporate Taxes

Value ofthe firm(VL )

VL VU TC B

Present value of taxshield on debt

VU

VU

Total Debt (B)

11

Debt, Taxes, and the WACC

- Taxes and firm value an example

- EBIT 100

- TC 30

- rU 12.5

- Q. Suppose debt goes from 0 to 100 at 10,

what happens to equity value, S? - VU EBIT(1 - TC) / rU

- VL

- SL VL - B

12

Debt, Taxes, and the WACC (concluded)

- WACC and the cost of equity (MM Proposition II

with taxes) With taxes - Recall WACC (S/A) rS (B/A) rB (1-TC)

- MM Proposition II (with taxes)

- rS rU (rU - rB) (B/S) (1 - TC )

- In the above example

- rs

- WACC

- The WACC decreases as more debt financing is used

- gt since WACC is a discount rate for future cash

flows, the optimal - capital structure is all debt!

13

Taxes, the WACC, and Proposition II

Cost of capital

rS

rU

rU

WACC

rB (1 TC)

Debt-Equity Ratio (B/S)

14

Financial Distress

- MM with taxes

- VL VU TC B

- debt provides tax benefits to the firm gt the

firm should borrow an infinite amount - In reality

- the firm has to pay interest and principal to

bondholders regardless of profitability - if the firm defaults on a payment to its

bondholders, it will enter a phase of financial

distress (e.g. Eatons), or - ultimately, if financial distress persists, the

firm will declare bankruptcy - there are costs involved in both financial

distress and bankruptcy

15

Costs of Financial Distress

- Direct Costs

- Legal and administrative costs (e.g. lawyers,

accounting, expert witnesses) - Indirect Costs

- Impaired ability to conduct business (e.g. lost

sales) - Agency costs -

- In financial distress, stockholders may engage

in - Selfish strategy 1 Incentive to take large risks

- Selfish strategy 2 Incentive toward

underinvestment - Selfish Strategy 3 Milking the property

(liquidating dividend, or Increase perks to

owners/management )

16

Selfish Strategy 3 Milking the Property

- Liquidating dividends

- Such tactics are often illegal

- Increase perks to owners/management

17

The Firm Value, Tax-Shield of Debt, and Financial

Distress Costs

- The Value of a levered firm

- VL VU TC B - PVexpected costs of financial

distress - For firms with a low financial leverage, the

probability of default is close to zero, and - PVexpected costs of financial distress 0

- a 1 increase in debt, will increase tax

benefits (and the firm value) at a constant rate

of TC - For highly levered firms, the probability of

default is positive, and - PVexpected costs of financial distress gt 0

- a 1 increase in debt, will

- increase tax benefits at a constant rate of TC

- increase costs of financial distress at

increasing rates - Conclusion - increase debt as long as tax

benefits exceed the PV - of the costs of financial distress (up to the

optimal level of debt B)

18

The Optimal Capital Structure and the Value of

the Firm

Value ofthe firm(VL )

VL VU TC B

Present value of taxshield on debt

Financial distress costs

Maximumfirm value VL

Actual firm value

VU

VU Value of firm with no debt

Total Debt (B)

B Optimal Level of Debt

19

The Optimal Capital Structure and the Cost of

Capital

WACC (S/V) rS (B/V) rB (1-TC) Premium

for Costs of Financial Distress

Cost ofcapital()

rS

rU

rU

WACC

Minimum cost of capital

rB (1 TC)

WACC

Debt/equity ratio (B/S)

(B/S) Optimal Leverage Ratio