Chapter 2: The Theory of Interest - PowerPoint PPT Presentation

1 / 77

Title:

Chapter 2: The Theory of Interest

Description:

... card interest a good idea? ... (reverse the Future Value Idea) r. Future Value Idea: A A' = (1 r) ... Don't forget the 'net' idea. Apples & Oranges Warning for ... – PowerPoint PPT presentation

Number of Views:98

Avg rating:3.0/5.0

Title: Chapter 2: The Theory of Interest

1

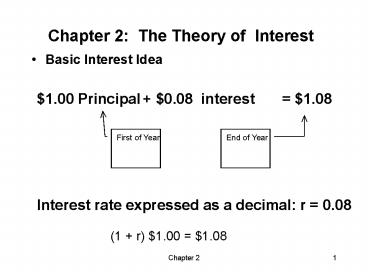

Chapter 2 The Theory of Interest

- Basic Interest Idea

1.00 Principal

0.08 interest

1.08

First of Year

End of Year

Interest rate expressed as a decimal r 0.08

(1 r) 1.00 1.08

2

Simple Interest Rate

3

Simple Interest Rate (Contd)

- If the proportional rule holds for fractional

years, after any time t (measured in years) then - V (1 r t) A

- Certificates of Deposit sometimes pay simple

interest.

4

Compound Interest Rate

5

Compound Interest Rate (Contd)

- Question. Would you rather have simple interest,

or compound interest? - Guesses Suppose you can get 10 compound

interest yearly on a 2,000 IRA. How much would

it be worth after 10, 20, 30 or 40 years?

6

Seven-Ten Rule

- (1.1)7 1.949. Money invested at 10 per year

doubles in about 7 years. - (1.07)10 1.967. Money invested at 7 per year

doubles in about 10 years. - Twenty-Eighty Rule

7

Compound Interest (Compound.xls)

8

Compound Versus Simple Interest

- Compound interest is said to exhibit geometric

growth. - Given the same annual rate, compound interest

always gives a greater value than simple

interest, since simple interest grows linearly.

9

Effective Interest Rate

- Compounding at other intervals than yearly e.g.,

daily, monthly, quarterly. - Quarterly compounding of an interest rate r for a

year applied to an amount A results in (1r/4)4 A

in a year. In this case, r satisfying 1 r

(1r/4)4 is called the effective interest rate

and r is nominal rate - Example r 0.08, r/4 0.02, 1 r (1.02)4

1.0824, r 0.0824 is the effective interest

rate. Note r gt r.

10

Continuous Compounding

- useful for modeling simplifications

- If an interest rate r is compounded m times per

year, after m periods, the result is - (1 r/m)m

- Further,

- lim m-gt ? (1 r/m)m er , where e ? 2.7818

- Example e0.08 1.0833, compared with (1.02)4

1.0824

11

Continuous Compounding (Contd)

- Continuous Compounding for t years gives

- (1 r/m)m t -gt er t

12

Debt

- You can also be on the paying end of compound

interest. It works both ways. - If you borrow money and do not make payments

after one year your debt is - (1r/12)12

(interest is charged monthly) - Interest rates change regularly and depend upon

the borrowing period - Question. Is paying credit card interest a good

idea? - (explain credit card tricks with grace period

and compound interest)

13

Credit Card Example (CrdCard.xls)

14

Present Value

- Present Value (reverse the Future Value Idea)

- r

- Future Value Idea A ? A (1r) A

-

d1 - Present Value Idea A 1/(1r) A d1 A ?

A - Example. If 100 is worth 108 in one year, then

the present value of that 108 is 100.

15

Example

- If 100 is worth 108 in one year, then the

present value of that 108 is 100. - Receiving 108 in one year is no different than

putting 100 in a bank and letting it earn 8

interest for one year. - If you owe 108 in one year, its present value is

just 100, since you could put 100 in the bank

today at 8 interest and have the money to pay

the debt in a year. - If you owe an amount A in one year, you could

put A/(1r) in the bank today at interest rate r

and have the money to pay the loan in a year.

16

Discounting

- (1-year) Discount Factor d1 1/(1r).

- Example r 0.08, d1 1/(10.08) ? 0.926

- Discounting the process of evaluating future

obligations as an equivalent present value. - Note, at 8, in two years

- 100 ? 108 ? 116.64

17

k-Period Discounting

- At 8 a year, the present value of a debt of

116.64 due in two years is 100. - More generally, with compounding of m equal

periods per year, and in k periods - dk 1/1 (r/m)k (k-period discount

factor) - Present value of a payment A to be received k

periods in the future is dk A.

18

PV FV of Streams

- Ideal Bank A bank which does the following

- applies the same rate of interest to both

deposits and loans - has no service charges or transactions fees

- its interest rate does not depend on the size of

the principal - separate transactions in an account are

completely additive in their effect on future

balances.

19

PV FV of Streams (Contd)

- Example of Ideal Bank

- 2-year CD offers same rate as a loan payable in 2

years. - Rates for 1-year and 2-year CDs need NOT be the

same.

20

Constant Ideal Bank

- Constant ideal bank is an ideal bank with

- an interest rate independent of the length of

time for which it applies - interest compounded according to normal rules

(ones we have presented for compound interest) - A constant ideal bank is the reference point

used to describe the outside financial market

the public market for money.

21

FV of Cash Flow Stream

- Cash Flow Stream (x0,x1, , xn)

- We have a fixed time cycle for compounding

(e.g., yearly), a period is the length of this

cycle. Cash flows occur at the end of each

period (some can be zero). We deposit each cash

flow in a constant ideal bank, paying r per

period.

22

FV of Cash Flow Stream (Contd)

- x0 grows to x0 (1r)n

- x1 grows to x1 (1r)n-1

- x2 grows to x2 (1r)n-2

- xn grows to xn (1r)n-n

- Future value of cash flow stream with interest

rate r per period is - FV x0 (1r)n x1 (1r)n-1 x2 (1r)n-2

xn

23

FV Example

- 2K invest in IRA each year for n years

24

FV Example (Contd)

25

PV of Cash Flow Stream

- Cash Flow Stream (x0,x1, , xn)

- We have a fixed time cycle for compounding (e.g.,

yearly), a period is the length of this cycle.

Cash flows occur at the end of each period (some

can be zero). We deposit each cash flow in a

constant ideal bank, paying r per period.

26

PV of Cash Flow Stream (Contd)

- x0 is now worth x0

- x1 is now worth x1 /(1r)1

- x2 is now worth x2 /(1r)2

- xn is now worth xn /(1r)n

- Present Value of cash flow stream with interest

rate r per period is - PV x0 x1 /(1r)1 x2 /(1r)2 xn/(1r)n

27

Example

- Stream (-2,1,1,1), r 0.10

- PV -2 1/(1.10) 1/(1.10)2 1/(1.10)3

- -2 0.9090 0.8264 0.7513 ? 0.4869.

- This present payment amount of 0.487 is

equivalent to the entire stream.

28

Relation of PV and FV

- Question

- FV x0 (1r)n x1 (1r)n-1 x2 (1r)n-2

xn - PV x0 x1 /(1r)1 x2 /(1r)2

xn/(1r)n - What do you get if you multiply PV by (1r)n ?

- Conclusion For a cash flow stream with rate r,

29

Relation of PV and FV (Contd)

- The FV and PV functions are both in Excel.

- Example Stream (-2,1,1,1), r 0.10.

- PV 0.487, FV 0.648,

- PV FV/(1.1)3 0.487.

- Both PV and FV are equivalent ways to think about

the stream.

30

Frequent and Continuous Compounding

- Cash Flow Stream (x0,x1, , xn)

- r nominal annual interest rate, interest

compounded at m equally spaced periods per year - PV x0 x1 /1(r/m)1 x2 /1(r/m)2

xn/1(r/m)n - Continuous Compounding at times t0, t1, , tn and

stream (x(t0),x(t1), , x(tn)) - PV x(t0)e-rt0 x(t1)e-rt1 x(tn) e-rtn

31

Equivalent Cash Streams

- Definition X and Y are equivalent if both

streams have the same PV, evaluated at the banks

interest rate r - Ideal bank can transform X to Y (Y to X)

- Example. With r 0.1, the following are

equivalent - (1,0,0), (0,0,1.21), (0,1.1,0), (a,b,c) for any

a, b, c with - 1 a b/(1.1) c/(1.1)2

32

Internal Rate of Return

- Motivating Example. An ideal bank offers you the

following - Deal 1. Invest 2,000 today. At the end of

years 1, 2, and 3 get 100, 100, and 500 in

interest at the end of year 4, get 2,200 in

principal and interest. - Question. Is this a good deal?

- Approach find out the implicit interest rate you

would be receiving that is, solve for - 2000 100 /(1r)1 100 /(1r)2 500/(1r)3

2200/(1r)4 - Solution r 10.7844 . This is the interest

rate for the PV of your payments to be 2,000.

33

Internal Rate of Return (Contd)

- Deal 2 At the end of years 1, 2, and 3 get 100,

100, and 100 in interest at the end of year 4,

get 2,000 in principal only. - We find r for which

- 2000 100 /(1r)1 100 /(1r)2 100/(1r)3

2000/(1r)4 - Solution r 3.8194.

- Which deal would you prefer?

- Would either deal be attractive?

34

Internal Rate of Return (Contd)

- How do we even know that the following equation

has a solution? - 2000 100 /(1r)1 100 /(1r)2

- 500/(1r)3 2200/(1r)4

- Let c 1/(1r). Rewrite the equation as

- -2000 100 c 100 c2 500 c3 2200 c4 0.

- This is now a 4th degree polynomial in c. We

know, from algebra, that an nth degree polynomial

has exactly n roots. However, we need to be sure

the roots are real numbers (and not imaginary).

We would also like them to be positive.

35

Internal Rate of Return (Contd)

- If c 0, f(c) -2000 lt 0. For c sufficiently

large, f(c) gt 0. Further, f is a continuous

function, and strictly increasing. The c value,

say c0, where f(c0) 0, (where the graph

intersects the origin) is therefore the only

real, positive root. Also f(1) 900 gt 0, so the

root satisfies c0 lt 1.

36

Internal Rate of Return (Contd)

- Observation. The number r satisfying

- 2000 100 /(1r)1 100 /(1r)2 500/(1r)3

2200/(1r)4 - i.e.,

- 0 -2000100 /(1r)1 100 /(1r)2 500/(1r)3

2200/(1r)4 - is also the number r for which the cash flow

stream - (-2000,100,100,500,2200) has PV 0, since

- PV x0 x1 /(1r)1 x2 /(1r)2 xn/(1r)n

37

Internal Rate of Return (Contd)

- Let (x0,x1, , xn) be a cash flow stream. The

internal rate of return (IRR) of this stream is a

number r satisfying - 0 x0 x1 /(1r)1 x2 /(1r)2 xn/(1r)n

- Remark. We use the word internal because the

rate of return depends only on the stream. It is

not defined with reference to the financial

world. It is the rate an ideal bank would have

to apply to generate the given stream from an

initial balance of zero.

38

IRR in EXCEL

39

Main Theorem of IRR

- Suppose the cash flow stream (x0,x1, , xn) has

- x0 lt 0, and xk ? 0 for k 1, , n with at

least one of x1, , xn positive. Then there is a

unique positive root to the equation - f(c) x0 x1 c x2 c2 xn cn

- Further, if x0 xn gt 0 (the total return

then exceeds the initial investment, x1 xn

gt -x0), then the corresponding IRR r (1/c) 1

is positive.

40

Proof of Main Theorem of IRR

- f(0) x0 x1 0 x2 02 xn 0n x0 lt0

- f(1) x0 x1 1 x2 12 xn 1n

- x0 x1 x2 xn gt 0

- since f is strictly increasing and continuous,

- root c0 satisfies the 0 lt c0 lt1 and

- IRR r0 (1/ c0) 1 is positive

41

Internal Rate of Return (Contd)

- Remark. One can make up cash flow streams where

no positive real root exists, or even where roots

are complex numbers. To do so you must violate

the hypotheses of the IRR Theorem. These

hypotheses are usually reasonable. - Note. Entries in CFS can be 0.

42

Net Present Value (NPV)

- Definition

- NPV PV of benefits - PV of costs

43

NPV in EXCEL

44

Evaluation Criterion NPV or IRR

- Example. Cutting Trees.

- Units in terms of 100,000.

- a) (-1,2) cut in one year

- b) (-1,0,3) cut after two years

- NPV Approach, assuming r 10

- a) NPV -1/1 2/(1.1) 0.82

- b) NPV -1/1 0/(1.1) 3/(1.1)2 1.48 gt 0.82

- Cut after two years choose option b)

45

Evaluation Criterion NPV or IRR (Contd)

- IRR Approach, c 1/(1r) ? r 1/c - 1

- a) 0 -1 2 c ? c ½ ? r 1, i.e., 100

- b) 0 -1 0 c 3 c2 ? c2 1/3 ? c 1/?3 ?

- r ?3 1 ? 0.732 lt 1.

- Cut after one year choose option a).

46

Evaluation Criterion NPV or IRR (Contd)

- Different decisions depending on evaluation

criterion - NPV gives b), IRR gives a).

- Insight. Use a longer planning horizon, reinvest

all earnings. Which looks better in 6 years? - a) 1 gt 2 gt 4 gt 8 gt 16 gt 32

gt 64 - cash flow stream (-1,0,0,0,0,0,64)

- b) 1 in 2 yearsgt 3 in 2 yearsgt 9

in 2 years gt 27 - cash flow stream (-1,0,0,0,0,0,27)

- a) Business doubles every year.

- b) Business triples every two years ? increases

by ?3 every year (in long run). - Multiplication coefficient is called grows rate

(GR) - since 2 gt ?3, a) has larger grows rate.

47

Evaluation Criterion NPV or IRR (Contd)

- a) IRR 2-1 for cut every year

- b) IRR ?3 1 for cut every 2 years

- This is no accident, but a general result. The

project with largest IRR also has the highest

growth rate.

48

Evaluation Criterion NPV or IRR (Contd)

- Conclusion 1. When the proceeds of the

investment can be repeatedly reinvested in the

same type of project but scaled in size, it makes

sense to choose the project with largest IRR to

get the greatest growth of capital. - Conclusion 2. NPV makes more sense for

one-shot projects.

49

Evaluation Criterion NPV or IRR (Contd)

- If we studied the cutting tree project for a

longer horizon than 1 year, the NPV approach

would also choose a). (Note with a longer

horizon there is ALSO more uncertainty. Further,

these rates of growth cannot continue

indefinitely.) - a) (-1,0,0,0,0,0,64) NPV 35.13

- b) (-1,0,0,0,0,0,27) NPV 14.24

- Theorists agree that, overall, the best criterion

is based on NPV. It provides consistency and

rationality.

50

Other Evaluation Factors

- 1) Which interest rate should we choose for NPV?

- the rate the bank pays on CDs

- the rate paid by the 3-month US Treasury bill

- the rate paid by the highest grade commercial

bond - the cost of capital rate the company must offer

to potential investors in company - 2) PV is not the whole story about the rate of

return. - Alternative 1. Invest 1,000, get a NPV of 100.

- Alternative 2. Invest 1,000,000, get a NPV of

100. - If you had 1,000,000, which alternative would

you choose?

51

Simplico Gold Mine

- You can lease a gold mine from its owners for up

to ten years. The lease is an up-front payment. - You can extract up to 10,000 oz. per year

- Each oz. costs 200.

- Market selling price for gold is 400/oz.

- Interest rate is 10

- All this information remains constant over the

10-year period (heroic assumption).

52

Simplico Gold Mine (Contd)

- Question. What is the most you would be willing

to pay for the lease?

53

Simplico Gold Mine (Contd)

- Answer. Compute PV of income from the mine,

assuming you operate it at full capacity for all

10 years. - Annual profit is (400 - 200) ? 10,000 oz/year

- 2 M.

- PV of annual profit for 10 years

- PV (2 M)/(1.1) (2M)/(1.1)2

(2M)/(1.1)10 12.29 M - If you paid more than 12.29M for the lease, you

would lose money on this undertaking.

54

Warnings

- Cash Flow Warning For each period t,

- cash flow income expense

- i.e., net income. Dont forget the net idea.

- Apples Oranges Warning for Cycle Problems. Be

certain to compare alternatives over the same

time horizon. The horizon can either be finite

or, in some cases, of indefinite length.

55

Automobile Purchase

- Alternative A.

- Car A costs 20,000

- Has annual maintenance cost of 1,000

- Has a useful lifetime of 4 years

- Has no salvage value

- Alternative B.

- Car B costs 30,000

- Has annual maintenance cost of 2,000

- Has a useful lifetime of 6 years

- Has no salvage value

56

Automobile Purchase (Contd)

- These alternatives are NOT over the same time

horizon. We can try a planning horizon of 12

years (3 Car As, 2 Car Bs). - Car A Analysis (3 cycles of 4 years each)

- One Cycle PV

- PVA 20,000 1,0001/(1.1) 1/(1.1)2

1/(1.1)3 - 22,487.

- Three Cycle PV (note the trick used here)

- PVA3 PVA 1 1/(1.1)4 1/(1.1)8 48,336.

57

Automobile Purchase (Contd)

- Car B Analysis (2 cycles of 6 years each)

- One Cycle PV

- PVB 30,000 2,0001/(1.1) 1/(1.1)2

- 1/(1.1)5

- Two Cycle PV (similar trick)

- PVB2 PVB 1 1/(1.1)6 58,795.

- Conclusion. For the 12-year period, using 3 of

Car A is cheaper than using 2 of Car B.

58

Machine Replacement

- How often should we replace a machine? Planning

horizon length is not known in advance - Purchase cost is 10,000 (would need to adjust

for inflation in reality) - First year operating cost is 2,000, no salvage

value. - Machine operating costs increases by 1,000 each

year (these costs incurred at end of year).

59

Machine Replacement (Contd)

- Replacing Machine Every Year

- Machine 1 CFS (-10,-2)

- Machine 2 CFS (0,-10,-2)

- Machine 3 CFS (0,0,-10,-2)

- etc

- Each stream looks identical to the one before,

except it starts one year later (and so must be

discounted by 10). - Conclusion. For an indefinite number of 1-year

replacements, - PV 10 2/(1.1) PV/(1.1) ? PV 130

- (i.e., 130,000)

60

Machine Replacement (Contd)

- Replacing Machine Every 2 Years

- Machine 1 CFS (-10,-2,-3)

- Machine 2 CFS (0,0,-10,-2,-3)

- Machine 3 CFS (0,0,0,0,-10,-2,-3)

- etc

- Each stream looks identical to the one before,

except it starts two years later (and so must be

discounted by 10 for 2 years). - PV 10 2/(1.1) 3/(1.1)2 PV/(1.1)2

- 14.2975 PV/1.21

- 1.21 PV PV 1.21 ? 14.2975 ? PV 82.381

61

Replacing Machine Every k Years

- PV (cost of one cycle of k years) PV/(1.1)k ?

- (1.1)k 1 PV (1.1)k ? cost of 1 cycle of k

years ? - PV (1.1)k ? cost of 1 cycle of k years /

(1.1)k-1 - Just compute the cost of one cycle of k years,

and then compute the PV using the latter formula.

62

Replacing Machine Every k Years

- See Table 2.3, p. 31. Replacing machine every 5

years is cheapest.

63

Taxes

- Suppose you can get 100/year in dividends

annually for two years. You are in the 28

income tax bracket. The time value of money is

10. - Not considering taxes, the PV of dividends is

- PVno tax 100/1.1 100/(1.1)2 90.91

82.64 - 173.55

- Due to taxes, 100 gt (1-0.28)100 72 ,

- the actual PV of the dividends is

- PVtaxes 72/1.1 72/(1.1)2 65.45 59.50

- 124.95.

64

Taxes (Contd)

- Consequently

- PVno tax 100 / 1.1 100 / (1.1)2

- PVtaxes (1-.28)100 / 1.1 (1-.28)100 / (1.1)2

- (1-.28) PVno tax

- To get PV with taxes

- You might now reject a project you would

otherwise accept.

65

Taxes (Contd)

- Assuming this tax rate is applied to all revenues

and expenses (it might not be), IRR would be

identical with or without taxes, e.g., - k 100/(1r) 100/(1r2) ?

- (1-t) k (1-t) 100/(1r) (1-t) 100/(1r2)

66

Taxes (Contd)

- When a uniform tax rate is applied to all

revenues and expenses as taxes and credits

respectively, recommendations from before-tax and

after-tax analyses are identical. - Example. Pay 150, today. Int. rate is 10, tax

rate 28. - Alternative A. Get 100 in 1 year, 100 more in

2 years. - Alternative B. Get 150 in 1 year, 50 more in 2

years.

67

Taxes (Contd)

- Alternative A.

- PVno tax 100/1.1 100/(1.1)2 90.91 82.64

173.55 - PVtaxes 72/1.1 72/(1.1)2 65.45 59.50

124.95. - Alternative B.

- PVno tax 150/1.1 50/(1.1)2 136.36

41.32 177.68 - PVtaxes 108/1.1 36/(1.1)2 98.18 29.75

127.93. - For comparison purposes, with, or without taxes,

Alternative B looks better. However, if you want

to know the actual PV with taxes, then you must

use the tax rate.

68

Depreciation Example

- We buy a machine for 10,000.

- It has a useful life of 4 years.

- It generates a cash flow of 3,000 each year.

- It has a salvage value of 2,000.

- The government requires depreciating the cost of

the machine over its useful life, e.g., if its

net cost to us over 4 years is 10,000 2,000

8,000, with straight-line depreciation we report

its annual cost each year as 8,000/4 2,000 .

69

Depreciation Example (Contd)

- Thus the taxable income it produces each year is

3,000-2,000 1,000. - If the combined federal and state tax rate is

43, we pay 430 tax each year. NPV is computed

at 10.

70

Depreciation Example (Contd)

- Bad News. Without taxes, NPV 876, so this

operation would be profitable. With taxes, NPV

-487, so it would not be.

71

Points About Inflation

- A new Volkswagen bug cost about 2,200 in 1962.

Today it costs about 16,000. - A good starting masters salary in IE was about

10,000 in 1962. What is it today? - Inflation is now running 2 to 3 a year in the

US. Some years it has been as much as 7 to 8

in the US during the last twenty years. - Some other countries have experienced

hyper-inflation. In Germany just after WW I, a

weeks wages could not be carried in both arms.

72

Inflation

- Inflation is an increase in general prices over

time - Inflation rate f prices are multiplied by (1f

) . - Constant (also called real) dollar keeps the

same purchasing power. - Actual (also called nominal, inflated, market )

dollars are used in transactions. - Let r be nominal interest rate, than the real r0

interest rate is given by - 1r0 (1r )/(1f )

- and

- r0 (r - f )/(1f )

73

Inflation (Contd)

- Money in the bank increases (nominally) by 1r ,

- but purchasing power is deflated by 1/(1f)

- Example. Inflation rate f0.04 ,

- nominal rate r 0.1, real rate r0 equals

- r0 (r - f )/(1f )(0.1- 0.04 )/(1

0.04)0.0577

74

Inflation (Contd)

- Question. What happens to the real rate of

interest if the rate of inflation exceeds the

nominal rate of interest? - Warning. Dont mix nominal dollars and real

dollars! Work consistently with one or the

other.

75

Inflation (Contd)

76

Inflation (Contd)

- The real cash flow has all values in todays

dollars. The nominal cash flows has values in

future years adjusted for inflation, e.g., 5000

5200/(1.04), so 5200 in a year is worth 5000

today. 5000 5408/(1.04)2, so 5408 in two years

is worth 5000 today, etc. - We get the same result either way (apart from

rounding errors).

77

Inflation (Contd)

- Note. It is common to estimate cash flow in

constant/real dollars relative to the present,

because then ordinary price increases (ones due

to inflation) can be neglected in a simple

estimation of cash flows. - Effects of Inflation on a 2,000 annual IRA

example is in the file infln-bp.xls