Percentage Tax 2551m PowerPoint PPT Presentations

All Time

Recommended

Taxumo delivers the best service for the most reasonable price available in the market. We keep you updated with the recent reforms and find you the grade-a option to save money and payable amount of taxes.

| PowerPoint PPT presentation | free to download

You can easily calculate tax under GST rates with GST Tax Calculator. If you want to calculate taxable and nontaxable GST by yourself, here's how to do it.

| PowerPoint PPT presentation | free to download

If you ever need help with Bir tax calculator filling up your tax forms, you are far more likely to find someone who can help you fill out your ITR than your AIF. Most people (yes, even accountants) don’t even know what an AIF is.

| PowerPoint PPT presentation | free to download

The credentials if not fulfilled accordingly then every single day you will face the problem. Also, the financial transaction regarding the taxation must be checked and placed thoroughly. With the invention of the new software for accounting and filling up the forms of tax this problem is reduced almost.

| PowerPoint PPT presentation | free to download

In recent the finance minister Mr. Arun Jaitley passed the new union budget for 2017-18. They have made some changes in income tax slab rate and rules. Know more about income tax and save.

| PowerPoint PPT presentation | free to download

Percentages Percentages - VAT 1. Valued Added Tax (VAT) is a tax that is charged at a rate of 17 of an items initial cost. Calculate the VAT that is charged on an ...

| PowerPoint PPT presentation | free to download

Percentages Discounts

| PowerPoint PPT presentation | free to download

TAXES By Stevie VanDeVelde Topics Purpose of taxes Different types of taxes What taxes you can expect to pay How to calculate the amount of federal income tax you owe ...

| PowerPoint PPT presentation | free to download

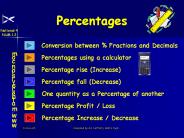

Percentages National 4 NUM 1.2 Conversion between % Fractions and Decimals www.mathsrevision.com Percentages using a calculator Percentage rise (Increase)

| PowerPoint PPT presentation | free to download

Taxes. Income taxes. Tax basics. Effective and marginal tax rates. What is taxable? ... State taxes. State income tax treatment of retirement income varies ...

| PowerPoint PPT presentation | free to view

How to calculate the amount of federal income tax you owe. Complete a 1040EZ ... Tax. Required contribution of money ... Estate, Inheritance and Gift Tax ...

| PowerPoint PPT presentation | free to download

Advance tax and Interest liability on failure to pay the Advance Tax

| PowerPoint PPT presentation | free to download

Taxes are a must for every taxable individual or corporate. As the saying goes “there is nothing certain except death and taxes”. Understanding, calculating and filing taxes in Hawaii is a tedious and complicated process for most people. Instead of copping with pressure and hassles of tax calculations and filing, it would be more prudent to hire an authorized tax agent in Hawaii.

| PowerPoint PPT presentation | free to download

Tax Liability is how much taxes a family owes and is based upon total income. ... Higher-income families pay a larger percentage of their income in taxes. ...

| PowerPoint PPT presentation | free to view

Save your hard earned money with the best tax savings schemes. Avail dual benefits of Tax saving investments under section 80C, of the income tax act, 1961 on investments & life insurance cover with tax-free returns.

| PowerPoint PPT presentation | free to download

If you are moving from another state to Karnataka then kindly be aware that you will have to pay lifetime Road Tax in Karnataka. However, if you plan to move out of the state within a year then you need not pay Road Tax however if you are planning to stay in Karnataka then its better you pay your Road Tax sooner to avoid any penalties

| PowerPoint PPT presentation | free to download

As the deadline looms threateningly on the horizon, taxpayers up and down the country are in the middle of preparing their taxes. However, with the current pandemic showing no signs of retreating yet, and a huge percentage of the population either in isolation or preparing to go into quarantine, many are concerned about how they will get their taxes done in time, if at all.

| PowerPoint PPT presentation | free to download

It is a matter of the fact that a Chicago tax lawyer can make your life easy. After all, our taxes are known for their bitterness. We are sure no one enjoys dealing with all those sickening numbers, percentages, square roots and other disgusting mathematics. However, a Chicago tax lawyer comes with training in this field, so it is not a big deal for them. We are sure; everyone can have his or her issues resolved by hiring a quality attorney or lawyer. They are great, they come with some amazing qualities. In our view, no one can manage tax issues as good as they can.

| PowerPoint PPT presentation | free to download

Paying taxes does not mean draining out all your hard-earned money. With the right tax experts and guidance, you can find ways to legally pay lesser tax. Visit Us: http://aaataxagentservices.com.au/

| PowerPoint PPT presentation | free to download

If you are moving from another state to Karnataka then kindly be aware that you will have to pay lifetime Road Tax in Karnataka. However, if you plan to move out of the state within a year then you need not pay Road Tax however if you are planning to stay in Karnataka then its better you pay your Road Tax sooner to avoid any penalties. If you are confused about the amount then go ahead and use our Road Tax Calculator to find out tentative amount now. After paying the road tax you also have to get your vehicle registered in Karnataka.

| PowerPoint PPT presentation | free to download

Start tax planning well before the year ends! Invest in the best tax savings plan to avail benefits under 80C of the income tax act, 1961. Secure your family's future with suitable life cover as well. Click know more https://www.bajajallianzlife.com/save-tax.jsp

| PowerPoint PPT presentation | free to download

Donate appreciated property and avoid capital gains tax ... File W-2 and other necessary tax forms for child. 26. Education Strategies. Tax Credits ...

| PowerPoint PPT presentation | free to view

Extended Mortgage Foreclosure Tax Relief ... Enhanced or Additional Child Tax Credit $1,000 credit ... Donate appreciated property and avoid capital gains tax ...

| PowerPoint PPT presentation | free to view

How to Find the Most Profitable Properties at the Palm Beach County Tax Deed Sale with Data Analytics

| PowerPoint PPT presentation | free to download

Owning a home comes with certain tax benefits as you enjoy certain tax deductions associated with property tax, mortgage interest as well as several other tax reliefs. Here we have outlined various tax benefits for a homeowner. You can read the full article here: https://bit.ly/2YB6gnG

| PowerPoint PPT presentation | free to download

If you’re the owner of a small business, trying to get prepped for your taxes can be a baffling time and while it’s often advisable to hire the services of tax professionals to help you sort them out, it’s also a good idea to have at least a basic knowledge of your own. Knowing how to save money through tax deductions can be extremely helpful, and below are a few pointers to set you going in the right direction:

| PowerPoint PPT presentation | free to download

Income Tax Preparation and returns filing are often considered as an additional burden and a source of worries. We have seen several taxpayers in a state of ultimate fear and anxiety when the IRS lead deadlines of returns submissions start approaching near.

| PowerPoint PPT presentation | free to download

There are several myths associated with tax audits. Don’t believe myths that says you must be afraid of the audit. In reality, there is nothing to be scared of. Also, as per the myth professionally filed returns are audit proof. In reality, paying an income tax preparer won’t shield you from the audit. For more details visit: https://jarrarcpa.com/tax-audits/

| PowerPoint PPT presentation | free to download

`Reducing taxes is a goal many of us aspire to, and by trying to understand our taxes better and become tax law savvy, we can often end up saving ourselves many dollars each year. Read on for the top ten tips for reducing your taxes:

| PowerPoint PPT presentation | free to download

The USA was the largest country accounting for $8.9 billion or 29.4% of the global tax audit services market. Read more: https://www.thebusinessresearchcompany.com/report/tax-audit-services-global-market-report-2018

| PowerPoint PPT presentation | free to download

Need help with creating an estimate of tax payments for your small business? This guide will break down everything that you need to know about estimated taxes payments for small businesses.

| PowerPoint PPT presentation | free to download

With the 2016 election around the corner, the U.S. has been debating what changes should be made to the U.S. tax code. This presentation questions if a national sales tax would be a viable solution.

| PowerPoint PPT presentation | free to download

One type of federal tax that Americans unwittingly pay is income tax. Lie 1: Federal income taxes are the main source of revenue for the federal government, contributing over 40% of its yearly tax revenue. TRUTH: NONE of the money you pay in federal income taxes goes to programs that benefit the people of America. President Reagan discovered via the Grace commission that it all goes to paying interest only on the national debt. Where does the U.S. Government get money for federal programs? It borrows it from the Federal Reserve, which is why we have a $20 Trillion dollar national debt.

| PowerPoint PPT presentation | free to download

The USA was the largest country accounting for $3.8 billion or 34.54% of the global tax preparation services market. Read More: https://www.thebusinessresearchcompany.com/report/tax-preparation-services-global-market-report-2018

| PowerPoint PPT presentation | free to download

Okay, so small business taxes might not be a subject we want to linger on, but for those of us out there who know that this same subject is going to keep coming around, year in year out, we may as well learn what we can in order to try and simplify the process and ensure that when it is tax time, we have to spend as little time preparing for it, as possible.

| PowerPoint PPT presentation | free to download

Availing tax services from an expert are crucial. But you must know how to pick the right professional. Want to know how? Read this content for more information - http://jarrarcpa.com/preparation/

| PowerPoint PPT presentation | free to download

http://propertytaxreductionnassau.com Save money on my Nassau County Property Tax Reduction with Cobra Consulting Group. File for Tax Grievance in Long Island. Call today @ 516-330-9930,917-929-9492

| PowerPoint PPT presentation | free to download

Getting the most out of your business tax deductions requires more than just the diligent tracking and filing of your expenses – to maximize your business returns, you need to know what you can and can’t claim come tax time. However, understanding what components of your business qualify for a tax deduction can be a challenge for many owners – you are busy enough as it is running your business. Prioritizing and tracking the expenses you can claim can fall to the wayside. Kent Accounting has put together a simple list of the best tax deductions for you to record and claim to make the most of your yearly tax return.

| PowerPoint PPT presentation | free to download

Tax Benefit Rule for State Tax Refunds Any state tax refund ... Thus, when the stock is sold there will be a negative adjustment relative to Regular tax. ...

| PowerPoint PPT presentation | free to view

Profit before Tax. 1241.05. PBT & Extraordinary Items. 123.46. Depreciation ... 120TPH boiler and a matching 22MW Turbo generator (turbine from Skoda) was set ...

| PowerPoint PPT presentation | free to view

MVA and EVA. Federal tax system. 2-2. The ... EVA takes into account the total cost of capital, which includes the cost of equity. ... What is the firm's EVA? ...

| PowerPoint PPT presentation | free to view

With more than 10 years of experience in Tax Preparation, Refund Man Taxes provides IRS-accredited service to our clients. Our team of expert tax preparation specialists will research the latest changes to the tax code, and bring about the most effective solutions ensuring our clients the financially rewarding outcome they deserve. We strive for continuous improvement by enrolling in annual IRS Certified Continuing Educational courses. Our attention to detail guarantees that our clients receive the maximum benefits allowed under the current laws and statutes. We ensure that clients do not pay unnecessary taxes and uncover all potential deductions and credits. We pride ourselves in preparing both simple and very complex tax returns.

| PowerPoint PPT presentation | free to download

Tax lien is nothing but when property owners fail to pay the property taxes, then local county government issues a legal certificate to remind delinquent property owners to pay back their property taxes completely. If you are in a confused state and need to know certain details about Tax Lien Investment, then get premium tax lien educations from professional mentors working in Tax Lien Company. We provide tools and technique and educate investors about the pros and cons involved in tax lien investment. For more details about Tax lien and its investment process, visit http://governmenttaxliennetwork.com/

| PowerPoint PPT presentation | free to download

One of the simplest ways of preparing for your taxes is to utilise the services of a tax professional, and recent statistics put around 60% of US tax paying citizens reportedly using paid preparers to submit their tax returns. While it is perfectly acceptable to go it alone - especially if you have a good head for such things – using a paid professional is the best way of eliminating errors and being sure to submit all the relevant information at the right time.

| PowerPoint PPT presentation | free to download

Many years have passed since there was last a tax reform - way back in the days of President Reagan, in fact – and the new ‘Tax Cuts and Jobs Bill’ that has recently been passed is bound to have an impact on all taxpayers, from individuals to business owners.

| PowerPoint PPT presentation | free to download

GST Overview: Know about 'Goods and Service Tax' smart Taxation System in India. Learn about GST, Indirect Tax structure in India before GST, GST Rates, GST Compensation Cess, Input Tax Credit, GST Composition Scheme, GST Return, TCS in GST eWay Bill and GST Audit through our PPTs and PDFs.

| PowerPoint PPT presentation | free to download

... incurred in connection with the determination, collection, or refund of any tax. Includes: ... Section 212 does not require that taxpayer is actually ...

| PowerPoint PPT presentation | free to view

Public health wants higher taxes, and. Policy makers are worried about the consequences of higher taxes to the economy as a whole. ...

| PowerPoint PPT presentation | free to view

Have you ever wondered “Why do I owe so much in taxes this year?” What can I do to make sure I don’t end up owing a big tax bill?” OR ANY BILL AT ALL WHEN I FILE MY INCOME TAXES?”

| PowerPoint PPT presentation | free to download

... governments will be much more difficult with the Circuit Breaker Tax Credits. ... Pay 08 Property Tax Relief factored into 08 tax bills (no refund) ...

| PowerPoint PPT presentation | free to view

A: The property will be placed on the tax roles and you will pay property taxes on it. ... You will not receive a refund for the taxes that have been paid. ...

| PowerPoint PPT presentation | free to view

Public policy review answers the question if illegal immigrants pay taxes and if they are good for the economy. The research shows how illegal immigrants take more out of the system than they pay into it.

| PowerPoint PPT presentation | free to view

Most countries have import taxes that are assessed on the value of the products imported. ... way to manage international taxes is to negotiate with ...

| PowerPoint PPT presentation | free to view

If you live in New York and your roof gets a lot of sunlight you’ve been approached about the potential of installing solar on your home. Although the awareness of solar is up, many homeowners have questions about some of the specifics of going solar. This article will explain exactly how the NY State Personal Tax Credit for solar energy systems work.

| PowerPoint PPT presentation | free to download

Government Tax Lien Network offers best Educational Training for students to know details about what a state tax lien is and how to invest in respective tax lien certificates. Tax lien is a first position lien on real estate due to delinquent property taxes. State Government issues a legal certificate for delinquent property owners to pay their taxes within certain time duration. Until property taxes are paid completely by delinquent property owners, those non paid properties are auctioned for sale. Those who are interested can buy the tax lien certificate through law procedures and can invest their valuable money in that delinquent property. Once property taxes are paid back, investors will get back their invested money with high percentage of interest. To know more details, about what is a state tax lien and its investment procedures, visit http://governmenttaxliennetwork.com/

The term 'percentage' is ubiquitous, to say the least. From promotional labels like extra items in a product pack and price discounts to fixed deposit rates, yearly appraisals, negotiating better cost-to-company (CTC) with HR and assessing students' performance in a class exam, the usefulness of percentage numbers is evident everywhere in our daily lives.