Chapter Outline PowerPoint PPT Presentation

1 / 37

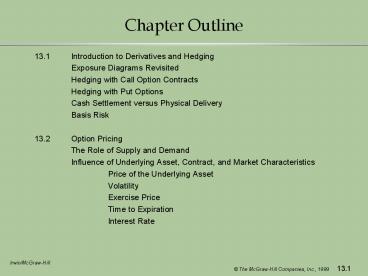

Title: Chapter Outline

1

Chapter Outline

- 13.1 Introduction to Derivatives and Hedging

- Exposure Diagrams Revisited

- Hedging with Call Option Contracts

- Hedging with Put Options

- Cash Settlement versus Physical Delivery

- Basis Risk

- 13.2 Option Pricing

- The Role of Supply and Demand

- Influence of Underlying Asset, Contract, and

Market Characteristics - Price of the Underlying Asset

- Volatility

- Exercise Price

- Time to Expiration

- Interest Rate

2

Chapter Outline

- 13.3 Hedging with Forward/Futures Contracts

- Forward Prices

- 13.4 Other Derivative Contracts

- Constructing Other Derivatives

- Swap Contracts

- 13.5 Comparison of Derivative and Insurance

Contracts - Market Prices versus Specific Losses

- Basis Risk and Extent of Risk Reduction

- Contracting Costs

- Moral Hazard and Adverse Selection

- Capital Costs

- Liquidity

- Summary

3

Chapter Outline

- 13.6 Markets for Derivatives

- Over the Counter versus Exchange Traded

Derivatives - Common Risks that are Hedged with Derivatives

- Foreign Exchange Derivatives

- Interest Rate Derivatives

- Commodity Derivatives

- Equity Derivatives

- 13.7 Reducing Risk Through Internal

Diversification - 13.8 Summary

4

Hedging Using Derivatives

- Important part of modern risk management

- Examples of the types of risk that are hedged

- commodity prices

- interest rates

- exchange rates

- Derivative markets are huge

- Integration of insurance and financial markets is

an important trend

5

Exposure Diagrams Revisited

- The Relation between Oil Prices and NeedOils

Profits

Profits

1.25 m

100 m

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

0.75 m

14 15 16

6

Hedging Oil Price Risk with Call Options

- NeedOil has oil price risk

- Issue How can it reduce its exposure?

- Solution

- NeedOil signs a contract with OPTCO where OPTCO

pays NeedOil - 250,000 x (Poil - 15) if Poil gt 15

- 0 if Poil lt 15

- OPTCO requires a premium equal to 100,000

7

Hedging Oil Price Risk with Call Options

- The Relation between Oil Prices and NeedOils

Payoff from its contract with OPTCO

NeedOils Payoff from its contract with OPTCO

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

14 15 16

8

Hedging Oil Price Risk with Call Options

- What are NeedOils profits?

- if oil price 14 gt

- profits from operations 1,250,000

- profits from OPTCO contract -100,000

- total profits 1,150,000

- if oil price 15 gt

- profits from operations 1,000,000

- profits from OPTCO contract -100,000

- total profits 900,000

- if oil price 16 gt

- profits from operations 750,000

- profits from OPTCO contract 125,000

- total profits 900,000

9

Hedging Oil Price Risk with Call Options

- The Relation between Oil Prices and NeedOils

Profits from Operations plus Profits from

contract with OPTCO

NeedOils Payoff from its contract with OPTCO

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

14 15 16

10

Call Option Contracts

- NeedOils contract with OPTCO is an example of a

derivative contract, called a call option. - A Derivative contract is a contract whose payoff

or value is derived from the value of some other

asset or index. - The asset on which the derivative contract is

based is called the underlying asset - A call option contract pays the purchaser of the

option a positive amount if the underlying asset

exceeds the exercise price. - The option price is the amount paid for the

option. - For every call option buyer, there is a call

option seller.

11

Selling a Call Option

- Payoff to a Seller (OPTCO) of a Call Option on

Oil with An Exercise price of 15

NeedOils Payoff from its contract with OPTCO

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

14 15 16

12

Put Options

- Put option contract receives a positive payoff

only if the value of the underlying asset falls

below the exercise price

NeedOils Payoff from its contract with OPTCO

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

14 15 16

13

Cash Settlement versus Physical Delivery

- Some options are settled in cash (like the ones

NeedOil used) - Other options are settled with the physical

delivery of the underlying asset - Example call option on oil 1,000 barrels with

exercise price of 15 - If oil price at expiration 18, then the option

buyer would exercise the option to buy 1,000

barrels for 15 a barrel

14

Basis Risk

- Basis risk refers to the uncertainty in the

relationship between the variable being hedged

and the derivative contract payoff being used to

hedge - Examples

- firm takes delivery in New Orleans, derivative

contract is based on New York prices - grade of the underlying asset used differs from

the grade on which the contract is based.

15

Determinants of the Price of Call and Put Options

- An Increase in Call Option Price Put Option

Price - the value of the

- underlying asset Increases Decreases

- the exercise price Decreases Increases

- the volatility in the

- return of the

- underlying asset Increases Increases

- the time to maturity Increases Increases

- interest rates Increases Decreases

16

Hedging with Forward Contracts

- Alternative method of hedging Contract with F-CO

- F-CO does not demand an upfront premium

- Instead NeedOil pays F-CO if the price of oil

falls below 15 - F-CO pays 250,000 x (Poil - 15) if Poil gt 15

- F-CO receives 250,000 x (15 - Poil) if Poil lt 15

17

Hedging with Forward Contracts

NeedOils Payoff from its contract with F-CO

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

14 15 16

18

Hedging with Forward Contracts

- A forward contract or a futures contract gives

the buyer (NeedOil) a symmetric payoff - equal to the difference between the actual price

of the underlying asset and some pre-determined

price - called the forward price or futures price.

19

Hedging with Forward Contracts

- Payoff to a F-CO, the Seller of a Forward

Contract

F-COs Payoff

Possible oil prices in six months in New Orleans

for the grade of oil NeedOil uses (/barrel)

14 15 16

20

Forward Prices

- Demand and supply of contracts determines the

forward price - People will always demand more contract or supply

more contracts unless - Cost of carry relationship is true

- forward price spot price at time t cost of

carry,

21

Example of the Cost of Carry Relationship

- Assume

- spot price of oil is 16 a barrel,

- the interest rate equals 9,

- cost of storing and insuring oil for one year is

1 - 1-yr forward price 16 16 x (0.09 0.01)

- 17.60

22

Example of the Cost of Carry Relationship

- Suppose the 1-yr forward price 18.00 and the

cost of carry equals 17.60 - Then, you could sell (take a short position) a

forward contract (agree to sell oil in one year)

at the 18.00 price. - Simultaneously,

- buy oil today

- store and insure the oil for 1 year for a total

of cost of 17.60 a barrel - at the end of the year, you would make 0.40

regardless of what happens to the price of oil

(i.e., there is no risk). - Therefore, 18.00 is not a price that will clear

the market

23

Derivatives Building Box

Buy a Forward

Buy a Call

Buy a Call

Buy a Call

Buy a Call

Buy a Call

24

Constructing Desired Payoffs

25

Constructing Desired Payoffs

26

Swap Contracts

- Swap contracts are a series of forward contracts

- Description of an Oil Swap

- Let Pt price of oil at time t

- 6 Mnths 12 Mnths 18 Mnths 24 Mnths

- Payoff (P6 mnths - 15) (P1 yr - 15) (P18

mnths - 15) P2 yrs - 15) - to NeedOil x 250,000 x 250,000 x 250,000 x

250,000 - Payoff to (15 - P6 mnths) (15 - P1 yr) (15

- P18 mnths) (15 - P2 yrs) SWAPCO x 250,000 x

250,000 x 250,000 x 250,000

27

Swap Contracts

- 2-year Interest Rate Swap Contract between

NeedOil and SWAPCO - rt one-year T-bill rate at time t

- each entry is multiplied by 1 million

- 6 Mnths 12 Mnths 18 Mnths 24 Mnths

- Payoff

- to NeedOil (r6 mnths - 5) (r1 yr - 5) (r18

mnths - 5) (r2 yrs - 5) - Payoff

- to SWAPCO (5 - r6 mnths) (5 - r1 yr) (5 -

r18 mnths) (5 - r2 yrs)

28

Comparison Of Derivatives Insurance

- Derivative contracts

- Usually used to hedge risk arising from

unexpected changes in market prices - Note market prices affect many firms

- Insurance contracts

- Usually for risk arising from losses specific to

the insured.

29

Comparison Of Derivatives Insurance

- Influence a particular firm has on payoffs from

- Derivative contracts - little, if any

- Insurance contracts

- Considerable, through its loss control activities

- gt greater moral hazard problems with insurance

- gt more investigation and monitoring costs must

be incurred with insurance contracts than with

derivatives - gt contracts with retention (deductibles,

limits, etc)

30

Comparison Of Derivatives Insurance

- Contracts based on firm specific factors (as

opposed to market prices or indices) have less

basis risk. - Derivative markets generally are more liquid than

insurance markets. - A liquid market exists when someone can sell or

buy an asset quickly with little price

concession. - Factors affecting liquidity

- Moral hazard problems

- Is creditworthiness involved?

31

Comparison Of Derivatives Insurance

- When prices change, there tend to be winners and

losers - gt firm values often are negatively correlated

- gt risk can be reduced with just two parties

- In contrast, the liability and property losses

tend to be independent across firms. - gt reduce risks by diversification with many

participants

32

Comparison Of Derivatives Insurance

- Summary of Main Differences

- Characteristics Derivatives Insurance

- Type of risk hedged Market price risk Firm

specific risk - Contracting costs

- (due to moral

- hazard, illiquidity) Low High

- Basis risk High Low

33

Institutional Material

- Over-the-Counter versus Exchange Traded

Derivatives - An over-the-counter (OTC) transaction resembles a

privately negotiated contract between two firms. - Exchange traded derivatives are standardized

contracts with the terms established by the

exchanges. - tend to be more liquid

34

Institutional Material

- The greater liquidity also is due in part to the

method used to ensure performance. - With OTC contracts, firms assess the default risk

(or credit risk) - With exchange traded contracts, default risk is

reduced by using - performance bonds, called margin

- daily marking to market

35

Institutional Material

- Example

- required margin 20 of the positions value

- value of position 1,000.

- you must post margin

- if futures price falls so the value equals 900

- amount lost on position is subtracted from margin

- gt you must add

- Margin and marking to market imply that you can

trade anonymously, which increases liquidity.

36

Main Types of Risk Hedged with Derivatives

- Foreign exchange rates

- break-down of the Bretton-Woods system of fixed

exchange rates in 1973 - Interest rates

- high level of interest rates in the 1970s and

1980s - 1979 change in FED policy

- Commodity prices

- Equity prices

37

Reducing Risk Through Internal Diversification

- Synergy exists when the combination of the parts

has greater value than the sum of the individual

values. - A potential source of synergy is the benefit from

reducing firm risk. - Internal diversification is also costly