Comparing Business Organizations PowerPoint PPT Presentation

1 / 24

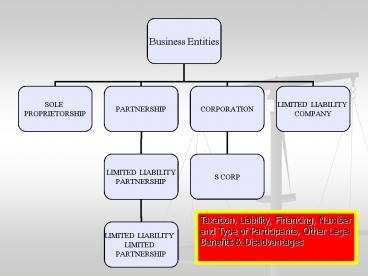

Title: Comparing Business Organizations

1

Taxation, Liability, Financing, Number and Type

of Participants, Other Legal Benefits

Disadvantages

2

General Partnerships

- Benefits

- NO DOUBLE TAXATION (Pass Through Taxation).

- Individuals Business Entities Can Be Partners.

- No Formal Process Required for Formation.

- Disadvantages

- Unlimited Liability

- UPA (Uniform Partnership Act)

- Articles of Partnership

3

Formation of a Partnership

- Voluntary

- Association of two or more persons

- Carrying on Business

- For Profit

- As Co-Owners

- Share Profits Losses and Important Management

Decisions - But see Creditors, Landlords

- No Express or Specific Intent Required.

4

Existence of a Partnership?

- FACTS Sweet was an hourly employee at Vohland

Nursery. After serving in the military Sweet

came back to work at the Nursery. There was no

written partnership agreement. Sweet did not

contribute any capital to the Nursery. Sweet

claims Vohland and him verbally agreed that Sweet

would have a 20 partnership interest in the

Nursery. Sweet Vohland sat down together on an

irregular basis every several weeks to determine

the Nurserys net profit. Sweet was then given a

check for 20 of the Nurserys net profit. No

social security or income taxes were withheld

from Sweets checks. Sweet claimed himself as

self-employed on his personal tax return paid

self-employment taxes. Vohland managed the

finances while Sweet managed the physical

operations of the Nursery. Sweet brings suit to

dissolve the partnership and collect his 20 of

the Nurserys inventory. - Q Did Vohland and Sweet enter into a

Partnership? - Q What if Sweet had received a pay-check every

two weeks that withheld social security and

income taxes?

5

Contributions Partnership Property

- Contributions of Capital, Labor, Assets

- Partnership Property

- Business v. Personal Use

- Majority of partners must agree to personal use.

- Personal Property Used in Business

- Partnership Property v. Personal Property

- RULE Totality of the circumstances.

- Presumptions

- Listed as an asset on Partnerships Books

- Partnership Paid Insurance on It

- Partnership Paid Taxes on It

6

Facts Allen bought a laptop from Best Buy with

his own personal money. Each day Allen brings

the laptop to work and allows the Partnerships

secretary to use it. Each night Allen takes the

laptop back home.

- Q Is the laptop Partnership property or

personal property being used by the Partnership? - A Personal property being used by Partnership.

- Q What if the Partnership paid for insurance on

the laptop? - A Could be personal or Partnership property.

7

Standard Partnership Provisions

- Partnership Name

- Voice in Management

- Equal Right to Participate in Management

(default) - Majority Rulegenerally partnersship decisions

only require majority of partners consent. - Unanimous Consent RequiredFor actions that are

contrary to Partnership Agreement or

fundamentally change the nature of the business.

8

FACTS Allen, Bob Carl formed a partnership

for the purpose of designing and selling tennis

shoes. The Partnership bought a retail shop

downtown. Bob hears the market in real estate is

really booming right now and wants to sell the

building for a profit. Bob convinces Allen that

the Partnership should sell the building. Carl

objects. Q Can Carl prevent Allen Bob

from selling the Partnerships downtown retail

building?

- ANSWER Unanimous Consent Required to

- Sell all of Business Inventory or Business

Building. - Guarantee Debts of a Partner.

9

Partnership Rights Duties

- Right to Compensation

- Profits Losses shared EQUALLY.

- Not entitled to wages, rent, interest.

- Duty to Inform.

- Duty to Account.

- Duty of Care in Partnership Business.

- Duty of Loyalty Good Faith

- Must not compete with or injure partnership.

- May not make secret profits.

10

FACTS Levy and Disharoon formed a partnership

for the purpose of purchasing a jet and operating

a charter airline service. Disharoon located a

jet and informed Levy that it could be purchased

for 963,000. After securing Levys approval,

Disharoon arranged to have the partnership borrow

975,000 to make the purchase. Unbeknownst to

Levy, Disharoon had actually contracted to buy

the jet for 860,000. Disharoon paid 860,000

for the jet and deposited 103,000 in his

personal bank account. Upon discovering

Disharoons misrepresentation, Levy sued for both

actual and punitive damages on a theory of breach

of loyalty and good faith.

- Q What duties did Disharoon breach, if any?

- A Duty to inform

- Duty of loyalty good faith

- Duty to account (maybe)

11

Partnership Authority

- Express Authority Partnership Agreement.

- Partnership Agreement can limit a partners

actual authority. - Implied Authority Every Partner is an Agent of

the Partnership. - Apparent Authority When 3rd Party Justifiably

Relies on Partners Implied Authority. - Partnership By Estoppelindividuals can be

estopped from leading 3rd parties to believe they

are partners when in fact they are not.

12

Partnership By Estoppel

- FACTS Leslie has not agreed to be partners with

Jamie, but Leslie accompanies Jamie to the Bank

where they speak with a loan officer. Jamie tells

the loan officer that she Leslie are going to

open a Bar together. Leslie does not correct

Jamie. The Bank loans Jamie 50,000. Leslie

does not share in the losses or profits from the

Bar and does not make any management decisions.

Jamie later defaults on the loan. The Bank sues

both Jamie Leslie to collect the debt. - Q Is Leslie Liable for the 50,000 loan?

- Q What if the Bank found out Leslie was not a

partner before loaning Jamie the 50,000?

13

Unlimited Liability

- Contract Liability

- Only jointly liable.

- Indemnification

- Tort Liability

- Partners jointly severally liable.

- Criminal Liability

- Partnership

- Individual Partners

14

FACTS Jose Joseph were both medical doctors

who were partners in a medical practice. Both

doctors treated Elaine Zuckerman during her

pregnancy. Her son was born with severe physical

problems. Zuckerman sued both Jose Joseph for

malpractice. The jury found Jose guilty, but

Joseph not guilty. The jury granted Zuckerman 4

million in damages.

- Q Can Zuckerman collect tort damages from

Joseph? - Answer Partners are jointly severally liable

for torts committed in the commission of the

partnerships business.

15

FACTS Jose Joseph were both medical doctors

who were partners in a medical practice. Both

doctors treated Elaine Zuckerman during her

pregnancy. Her son was born with severe physical

problems. Zuckerman sued both Jose Joseph for

malpractice. The jury found Jose guilty, but

Joseph not guilty. The jury granted Zuckerman 4

million in damages.

- Q If Jose was held criminally liable for

practicing medicine without a license would the

Partnership be liable? Would Joseph be liable? - Answer Partnership is liable, but Joseph is not

as long as Joseph did not directly participate in

or encourage the criminal behavior.

16

Facts Davis Mitchell formed a General

Partnership to purchase rental property for

investment purposes. The Partnership purchased

real property from Kemmler Foundation on credit.

Davis signed a 150,000 promissory note to the

Foundation as Cliff W. Davis, Partner. Before

executing the note, Davis Mitchell entered into

an agreement that provided only Davis AND NOT

Mitchell would be personally liable on the note.

Foundation had no knowledge of the agreement.

The Partnership defaults on the note.

- Q Is Mitchell Liable for the Note?

- Answer Mitchell is liable because Foundation

justifiably relied on Mitchells implied

authority. - Q What if the Foundation knew about the

agreement? - Answer Mitchell is not liable, because

Foundation did not justifiably rely on Mitchells

implied authority.

17

Liabilities of Outgoing Incoming Partners

- Liability of Outgoing Partners

- Continuation of Partnershipdeparting partner not

liable for any new debts obligations after

notifying creditors of his or her departure. - Novationagreement between creditors and

continuing partners to release withdrawing

partner from liability. - Liability of Incoming Partners

- Liable for existing debts obligations only to

the extent of his or her capital contribution. - Liability not limited as to debts obligations

incurred after becoming a partner.

18

Dissolution of Partnership

- Dissolution

- Types of Dissolution Non-Wrongful, Wrongful,

Automatic, By Court Order. - Terminates partners actual authority to enter

into contracts and act on behalf of the

partnership. - DOES NOT terminate Partnerships or personal

liability. - Partnership at Will v. Partnership for a Term

- Power to Withdraw at any time.

- Right to Withdraw Wrongful Dissolution

- Notice of DissolutionFailure to properly notify

3rd parties may create liability based on

apparent authority. - Actual Notice (3rd parties that actually dealt

with partnership) - Constructive Notice (3rd parties that had

knowledge of partnership) - No Notice (3rd parties that had no knowledge of

partnership) - Continuation of Partnership After Dissolution

19

Winding Up Partnership

- Distribution of Assets

- Outside Creditors of the Firm.

- Debts owed to Partners.

- Return of each partners Capital Contribution.

- Remaining assets divided as profits according to

Articles of Partnership. - Compensation for Winding Up

- Only upon death of a partner are surviving

partners entitled to compensation.

20

Limited Partnership

- (Revised) Uniform Limited Partnership Act RULPA

- Requires General Partner(s) Limited Partner(s)

- General Partnersmanage business, personally

liable. - Limited Partnerscan not manage business, but

limited in liability to only invest capital. - Any person or business entity can be a general or

limited partner. - Corporations as General Partnerliability limited

to its assets. - FormationCertificate of Limited Partnership

- Filed with secretary of state and, sometimes, in

counties where LP conducts business. - LP name, general character of business, principle

place of business, names addresses

distinction of each partner, dissolution date,

description amount of each partners capital

contribution, etc.

21

Partners Liability in aLimited Partnership

- Liability

- General Partnersunlimited liability

- Limited Partnersliable only to extent of

investment - Exceptions

- Limited Partners actions led 3rd party to

reasonably believe the limited partner was a

general partner - Personal Guarantees

- Rights

- Limited Partnersno right to act on LPs behalf

22

Limited Partnership

- Defective Formation

- Certificate not properly filed.

- Defects in Certificate.

- Other statutory requirements not met.

- Limited Partners become liable as General

Partners - Liable to 3rd parties who transact business with

the enterprise before defective formation is

corrected. - Correcting Good Faith Defective Formation (2

options) - Cause appropriate certificate to be filed.

- Withdraw from any future equity participation and

file certificate showing withdrawal.

23

Limited Liability Partnership (LLP)

- All partners are limited partners (no general

partners) - No Personal Liability beyond capital investment.

- Government filing required (Domestic LLP v.

Foreign LLP) - Liability insurance required.

- Restricted to Certain Professions (most states)

24

Comparing Business Organizations