Daily Grind Case PowerPoint PPT Presentation

1 / 53

Title: Daily Grind Case

1

Daily Grind Case

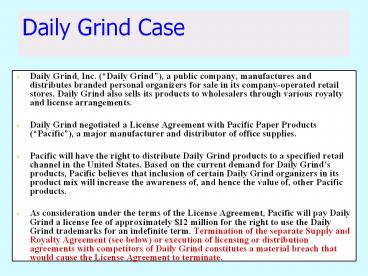

- Daily Grind, Inc. (Daily Grind), a public

company, manufactures and distributes branded

personal organizers for sale in its

company-operated retail stores. Daily Grind also

sells its products to wholesalers through various

royalty and license arrangements. - Daily Grind negotiated a License Agreement with

Pacific Paper Products (Pacific), a major

manufacturer and distributor of office supplies. - Pacific will have the right to distribute Daily

Grind products to a specified retail channel in

the United States. Based on the current demand

for Daily Grinds products, Pacific believes that

inclusion of certain Daily Grind organizers in

its product mix will increase the awareness of,

and hence the value of, other Pacific products. - As consideration under the terms of the License

Agreement, Pacific will pay Daily Grind a license

fee of approximately 12 million for the right to

use the Daily Grind trademarks for an indefinite

term. Termination of the separate Supply and

Royalty Agreement (see below) or execution of

licensing or distribution agreements with

competitors of Daily Grind constitutes a material

breach that would cause the License Agreement to

terminate.

2

Daily Grind Case

- The License Agreement specifies that the license

fee is earned, payable, and contractually

non-refundable as of the date of execution of the

License Agreement. - Daily Grind and Pacific also entered into a

separate Supply and Royalty Agreement. Based on

this agreement, Daily Grind will allow Pacific to

distribute personal organizers manufactured by

Daily Grind to a specified retail channel in the

United States. As part of the Supply and Royalty

Agreement, Pacific agreed to pay Daily Grind

quarterly royalty payments based upon a

predetermined royalty schedule. If Daily Grind

cannot or does not provide the amount of product

Pacific requires under the Supply and Royalty

Agreement, Pacific maintains the right to enter

into a separate manufacturing contract that would

allow Pacific to use certain of Daily Grinds

proprietary production methods. - The sales terms (e.g., price, discounts) under

the Supply and Royalty Agreement do not differ

from the terms of other arrangements Daily Grind

has with third parties to sell its products. The

Supply and Royalty Agreement will expire ten

years from the date of its execution and will

renew automatically for successive ten-year terms

thereafter, unless a material breach of contract

occurs. Termination of the License Agreement (see

above), non-payment of royalties due, or failure

to meet sales performance goals would constitute

a material breach under the terms of the Supply

and Royalty Agreement. An independent party has

evaluated the sales performance goals and has

deemed them to be substantive.

3

Daily Grind Case

- Daily Grind has experience in both license and

royalty arrangements and believes that both the

License Agreement and the Supply and Royalty

Agreement are priced at their respective fair

values. Further supporting their conclusions,

Daily Grind plans to engage an independent

valuation expert to verify that the terms of the

agreements are at fair value. - Required Is it appropriate for Daily Grind to

recognize the 12 million payment from Pacific

under the terms of the License Agreement as

revenue upon execution of the License Agreement?

4

Daily Grind Case

- An assessment must be made to determine if, in

essence, the 12 million nonrefundable fee was to

obtain the on-going right to obtain and sell

Daily Grinds products or if Pacific places a

separate value on the License Agreement. - With regard to loan origination fees that are

assessed by a creditor for the origination of a

loan, paragraph 37 of FASB Statement No. 91,

states the following The Board concluded that

loan origination fees and direct loan origination

costs should be accounted for as components of a

loan's acquisition cost and recognized as an

adjustment to the yield of the related loan. The

Board considered and rejected the argument that

loan origination is a separate revenue-producing

activity and concluded that originating loans is

but one means of acquiring a loan.

5

Daily Grind Case

- SAB No. 101 states, unless the up-front fee is

in exchange for products delivered or services

performed that represent the culmination of the

earnings process, the deferral of revenue is

appropriate.

6

Daily Grind Case--Conclusion

- 1. Given that termination of the License

Agreement or the Supply and Royalty Agreement

would result in termination of the other

corresponding agreement, signing the License

Agreement was not a discrete event for which the

earnings process had been culminated. - 2. Further, as the License Agreement has an

indefinite term and the Supply and Royalty

Agreement has an initial ten-year term that

renews automatically for successive ten-year

terms, revenue from the License Agreement should

be recognized over the initial contract period

(or longer if the relationship with Pacific is

expected to extend beyond the initial term and

Pacific continues to benefit from the payment of

the up-front fee).

7

Revenue Recognition Over Time

Completed Contract Method

Long-term Construction Contracts

Percentage-of-Completion Method

8

Percentage-of-Completion Method

Measuring Progress Toward Completion

Cost incurred to date

Estimate of projects total cost

Gross profit estimate

9

Percentage-of-Completion Method

10

Percentage-of-Completion Method

Geller Construction entered into a three-year

contract to build a containment vessel for

Southeast Power Company. Presented below is

information about the contract.

Lets see how Geller will account for the

revenues and cost of this project using the

percentage-of-completion method.

11

Percentage-of-Completion Method

12

Percentage-of-Completion Method

13

Percentage-of-Completion Method

14

Percentage-of-Completion Method

15

Percentage-of-Completion Method

16

Percentage-of-Completion Method

17

Percentage-of-Completion Method

18

Percentage-of-Completion Method

19

Percentage-of-Completion Method

800,000 - 250,000 last year 550,000

20

Percentage-of-Completion Method

775,000 - 250,000 last year 525,000

21

Percentage-of-Completion Method

695,000 - 225,000 last year 470,000

22

Percentage-of-Completion Method

23

Percentage-of-Completion Method

24

Percentage-of-Completion Method

25

Percentage-of-Completion Method

26

Percentage-of-Completion Method

27

Percentage-of-Completion Method

Entry to transfer title to the customer.

28

A Thought Exercise E5-11

29

A Thought Exercise E5-11

- Requirement 1

- Construction in progress Costs incurred

Profit recognized - 100,000 ? 20,000

- Actual costs incurred in 2003 80,000

30

A Thought Exercise E5-11

- Requirement 2

- Billings Cash collections Acc. Rec.

- 94,000 ? 30,000

- Cash collections in 2003

- 64,000

31

A Thought Exercise E5-11

- Requirement 3

- Let A Actual cost in 2003

- Let T Actual cost in 2003 Estimated cost to

complete - Thus, A/T complete

- and A/T (Price T) Profit recognized in

2003 - T (A/T) (Price T) T (Profit)

- A (Price T) T (Profit)

- 80,000 (1,600,000 T) T 20,000

- Dividing both sides by 20,000

- 4 (1,600,000 T) T

- Thus, 6,400,000 4T T

- 6,400,000 5T

- T 1,280,000 80,000 Estimated cost to

complete - Estimated cost to complete 1,280,000 - 80,000

1,200,000

32

A Thought Exercise E5-11

- Requirement 4

- 80,000 X 1,280,000

- X 6.25

33

Completed Contract Method

Geller Construction entered into a three-year

contract to build a containment vessel for

Southeast Power Company. Presented below is

information about the contract.

Lets see how Geller will account for the

revenues and cost of this project using the

completed contract method.

34

Completed Contract Method

Gross profit is not recognized until project is

complete.

Entries are identical to the entries for

percentage of completion.

35

Completed Contract Method

Gross profit is not recognized until project is

complete.

Entries are identical to the entries for

percentage of completion.

36

Completed Contract Method

Gross profit is recognized in year 3 since

project is complete.

37

Completed Contract Method

Entry to transfer title to the customer.

38

Significant Uncertainty of Collectibility

When uncertainties about collectibility exist,

revenue recognition is delayed.

- Installment Sales Method

- Cost Recovery

39

Installment Sales Method

- Sale and cost of sale recorded as usual.

- Compute gross margin rate on the installment

sales. - Recognize gross margin as cash is received.

- Gross margin not realized is deferred until a

future period.

40

Installment Sales Method

Clarke, Inc. had the following installment sales

in addition to its regular sales.

41

Installment Sales Method

Clarke, Inc. had the following installment sales

in addition to its regular sales.

At Dec. 31, 2005, Clarke, Inc. is still owed

30,000 from the 2004 sales and 75,000 from the

2005 sales.

42

Installment Sales Method

During 2003, Clarke collected 100,000 on its

installment sales.

Deferred gross profit is the difference between

the selling price and the cost of the inventory.

43

Installment Sales Method

This entry records the Realized Gross Profit by

adjusting the Deferred Gross Profit account.

44

Installment Sales Method

During 2004, Clarke collected 50,000 on its 2003

installment sales and 195,000 on its 2004

installment sales.

45

Installment Sales Method

During 2004, Clarke collected 50,000 on its 2003

installment sales and 195,000 on its 2004

installment sales.

46

Installment Sales Method

47

Installment Sales Method

48

Installment Sales Method

Balance Sheet

49

Cost Recovery Method

Clarke, Inc. had the following installment sales

in addition to its regular sales. The company

uses the cost recovery method to account for

installment sales.

45,000 200,000 22.50

50

Cost Recovery Method

The following schedule shows the pattern of cash

collections for the three year period.

Under the cost recovery method profit is not

recognized until the seller has recovered all of

the cost of the goods sold.

51

Cost Recovery Method

The entries are exactly the same as under the

Installment MethodEXCEPT that there is not an

entry to realize gross profit. Since we have not

collected cash in excess of COGS, no gross profit

is recognized in 2003.

52

Cost Recovery Method

In 2004, lets concentrate on the entries

relating to 2003 sales only.

Now can we recognize some profit?

53

Cost Recovery Method

Here are the entries we would make in 2005

relating to 2003 sales.

We have fully recovered the 155,000 cost during

2005, so the entire deferred gross profit will be

recognized.