Credit Default Swap PowerPoint PPT Presentation

Title: Credit Default Swap

1

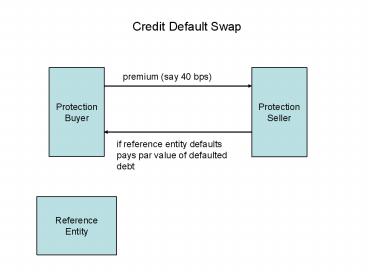

Credit Default Swap

Protection Buyer

Protection Seller

premium (say 40 bps)

if reference entity defaults pays par value of

defaulted debt

Reference Entity

2

Credit Default Swap

Protection Buyer

Protection Seller

premium (say 40 bps)

if reference entity defaults pays par value of

defaulted debt

Physical Settlement protection buyer sells

defaulted assets to protection seller for par

value. Cash Settlement counterparties poll

market to determine recovery value of defaulted

assets then protection seller pays the

difference between par and recovery value to

protection buyer

3

Valuation Floating Rate Reference Asset

Protection Buyer

Protection Seller

premium (say 40 bps)

A

B

if reference entity defaults pays par value of

defaulted debt

LIBOR spread

As rate with the swap LIBOR spread - premium

Risk-free rate LIBOR Therefore premium

spread

Reference Asset

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics, the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.