Bank Credit Cards - PowerPoint PPT Presentation

1 / 20

Title:

Bank Credit Cards

Description:

merchants volume of credit card activity. average size of each sale ... Suppose your credit card has $100 balance on 5/31 and there will be no finance ... – PowerPoint PPT presentation

Number of Views:178

Avg rating:3.0/5.0

Title: Bank Credit Cards

1

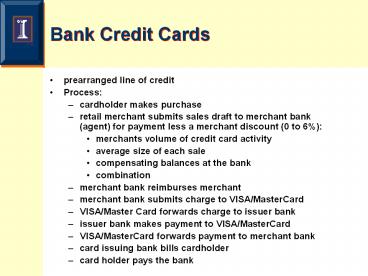

Bank Credit Cards

- prearranged line of credit

- Process

- cardholder makes purchase

- retail merchant submits sales draft to merchant

bank (agent) for payment less a merchant discount

(0 to 6) - merchants volume of credit card activity

- average size of each sale

- compensating balances at the bank

- combination

- merchant bank reimburses merchant

- merchant bank submits charge to VISA/MasterCard

- VISA/Master Card forwards charge to issuer bank

- issuer bank makes payment to VISA/MasterCard

- VISA/MasterCard forwards payment to merchant bank

- card issuing bank bills cardholder

- card holder pays the bank

2

Calculation of Finance Charges

- Suppose your credit card has 100 balance on 5/31

and there will be no finance charge if paid by

6/30. On June 1 you make 100 purchase. On June

15 you make a 20 payment on the loan. The

interest rate charged is 1.5 monthly or 18

annually. - What is the finance charge?

- 4 Methods

- adjusted balance

- previous balance

- average daily balance excluding current

- average daily balance including current

3

Loan Pricing

4

Issues

- Average funding costs vs. marginal funding costs

- Linkage to interest rate risk

- Customer profitability analysis

- Compensating balances

- Allocate costs over maturities 1 year

- Evaluate trade-off of fees for price

- Differential pricing

5

Use of differential pricing

- General use

- Credit risk

- Size of loan

- Purpose of loan

- Maturity of loan

- Funding source

6

Competition

- Risks

- credit

- collateral

- interest rate

- other

Customer Relationships

- Loan Price

- interest rate

- fees

- Cost of funds

- debt

- equity

- Administrative costs

- direct loan costs

- overhead costs

Bank Value

7

Components of loan pricing

- Administrative costs

- Funding costs

- debt

- equity

- Risk bearing costs

8

Formula

- Lb loan balance

- A administrative costs

- Ide institutional debt and equity

- R risk bearing

- F fees charged

9

Administrative costs

- Loan officer time

- Back office evaluation

- Credit evaluations/searches/appraisals

- Brick and mortar

- Legal

- Processing

10

Commercial Bank Lending Costs of Various

Products,

Deposits

Deposits

Deposits

Up to 50M

50M to 200M

Over 200M

-------- percent of functional volume -------

Real Estate Loans

Salaries and fringe

0.88

0.76

0.64

Total operating expenses

1.46

1.30

1.06

Commercial Loans

Salaries and fringe

1.51

1.54

1.50

Total operating expenses

2.42

2.69

2.50

Installment Loans

Salaries and fringe

2.37

2.17

1.94

Total operating expenses

4.43

4.11

3.56

Source National Average Report, Functional Cost

and Profit Analysis,

Federal Reserve Banks.

11

Cost of Funds

- Marginal vs. average costs

- Include cost of equity (before tax)

- Cost of reserves

- net funds available

- Financial and non-financial costs

12

Commercial bank's nonfinancial cost of deposits,

Deposits

Deposits

Deposits

Up to 50M

50M to 200M

Over 200M

-------- percent of functional volume -------

Demand deposits

Noninterest bearing

6.59

5.39

5.37

Interest bearing

1.36

1.88

2.60

All demand deposits

3.53

3.95

4.67

Time Deposits

Regular savings

2.51

2.33

1.98

MMDA

0.51

0.69

0.68

Other time deposits

0.18

0.36

0.11

All time deposits

0.56

0.68

0.66

Source National Average Report, Functional Cost

and Profit Analysis,

Federal Reserve Banks

13

Example

- Suppose a bank typically funds 50 noninterest

bearing transaction accounts 50 time deposits. - Hold 10 reserves on noninterest bearing accounts

- Target after-tax ROE 20

- Tax bracket at bank is 28

- Equity-asset requirement at bank is 10

- Time deposits 5 marginal interest cost

- Use non-financial values (all) from FCA

- Fund 200,000 loan

- Estimated cost of funds?

14

Risk bearing costs

- Risks that are sometimes priced

- credit

- maturity

- collateral value risk

- interest rate risk

- cap risk

- prepayment risk

- liquidity risk

15

Total Costs

- Administrative Costs

- Funding Costs

- Risk Bearing Costs

16

Term loans

- Closing costs

- Closing fees

- Evaluate interest vs. fees?

17

Assumptions6 reinvestment rate and 10 loan

interest charge

18

Using Time Value of Money Concepts

- Goal A. To price a cost over the length of the

loan?B. To determine a method to trade-off fees

for interest rate?For A - Step 1 determine annuity payments w/original

interest rate - Step 2 calculate the equal annual annuity for

additional costs (discounted at cost of funds) - Step 3 add the results from 1 and 2 and solve

for interest rate.

19

Using Time Value of Money Concepts

- Goal A. To price a cost over the length of the

loan?B. To determine a method to trade-off fees

for interest rate?For B - Step 1 determine annuity payments w/original

interest rate - Step 2 determine annuity payments w/proposed

interest rate - Step 3 calculate the present value of annual

annuity for difference

20

Examples