The BaumolTobin Model - PowerPoint PPT Presentation

1 / 40

Title:

The BaumolTobin Model

Description:

Money supply (M) is linked to H via the money multiplier, mm Figure shows this relationship: ... mm = money multiplier or stock of money to the stock of high ... – PowerPoint PPT presentation

Number of Views:1242

Avg rating:3.0/5.0

Title: The BaumolTobin Model

1

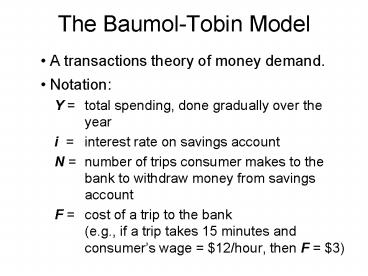

The Baumol-Tobin Model

- A transactions theory of money demand.

- Notation

- Y total spending, done gradually over the year

- i interest rate on savings account

- N number of trips consumer makes to the bank

to withdraw money from savings account - F cost of a trip to the bank(e.g., if a trip

takes 15 minutes and consumers wage 12/hour,

then F 3)

2

Money holdings over the year

- N 1

Average Y/ 2

3

Money holdings over the year

N 2

Y

Y/ 2

Average Y/ 4

4

Money holdings over the year

N 3

Y

Average Y/ 6

Y/ 3

5

Cost of Holding Money

- In general, average money holdings Y/2N

- Foregone interest i ?(Y/2N )

- Cost of N trips to bank F ?N

- Thus,

- Given Y, i, and F, consumer chooses N to

minimize total cost

6

Finding the cost-minimizing N

7

Cost of Holding Money

- Set holding and transaction costs equal to each

other - i ?(Y/2N ) F ?N

- Thus,

8

Transaction Demand

- In general

- Starting income of Y

- n trips to the bank

- ? The average cash balance is

- Each trips costs tc

- ? The combined cost of trips plus forgone

interest is - Choose n to minimize costs and compute the

average money holdings ? Baumol-Tobin formula for

the demand for money -

-

(1)

9

The Money Demand Function

- The cost-minimizing value of N

- To obtain the money demand function, substitute

N into the expression for average money

holdings (Y/2N)

- Money demand depends positively on Y and F, and

negatively on i .

10

Cost of Holding Money

- If the interest rate is 5 and the cost of a trip

to the bank/ATM is Sk100, what is the number of

trips to the bank/ATM that minimizes the cost of

holding money if your total yearly spending is

Sk1.000.000? What is the average money holding?

N 15.8

Sk31.623

11

Financial Innovation, Near Money, and the Demise

of the Monetary Aggregates

- Examples of financial innovation

- many checking accounts now pay interest

- very easy to buy and sell assets

- mutual funds are baskets of stocks that are easy

to redeem - just write a check - Non-monetary assets having some of the liquidity

of money are called near money. - Money near money are close substitutes, and

switching from one to the other is easy.

12

Financial Innovation, Near Money, and the Demise

of the Monetary Aggregates

- The rise of near money makes money demand less

stable and complicates monetary policy. - 1993 the Fed switched from targeting monetary

aggregates to targeting the Federal Funds rate. - This change may help explain why the U.S. economy

was so stable during the rest of the 1990s.

13

Money in the Economy

- Currency is the paper bills and coins in the

hands of the public. - Demand deposits are balances in bank accounts

that depositors can access on demand by writing a

check.

14

CASE STUDY Where Is All The Currency?

- In 2005 there was about 4,596 in currency per

adult, half of which is in 100 notes. - Who is holding all this currency?

- Currency held abroad

- Currency held by illegal entities

15

Banks role in the money supply

- The money supply equals currency plus demand

(checking account) deposits - M CU D

- Since the money supply includes demand deposits,

the banking system plays an important role.

16

Preliminaries

- Reserves (R ) the portion of deposits that

banks have not lent. - To a bank, liabilities include deposits,

- assets include reserves and outstanding loans

- 100-percent-reserve banking a system in which

banks hold all deposits as reserves. - Fractional-reserve banking a system in which

banks hold a fraction of their deposits as

reserves.

17

SCENARIO 1 No Banks

- With no banks, D 0 and M CU 1000.

18

SCENARIO 2 100 Percent Reserve Banking

- Initially CU 1000, D 0, M 1000.

- Now suppose households deposit the 1000 at

Firstbank.

- After the deposit, CU 0, D 1000,

M 1000. - 100 Reserve Banking has no impact on size of

money supply.

reserves 1000

deposits 1000

19

SCENARIO 3 Fractional-Reserve Banking

- Suppose banks hold 20 of deposits in reserve,

making loans with the rest. - Firstbank will make 800 in loans.

- The money supply now equals 1800

- The depositor still has 1000 in demand deposits,

- but now the borrower holds 800 in currency.

deposits 1000

reserves 1000

reserves 200 loans 800

20

SCENARIO 3 Fractional-Reserve Banking

Thus, in a fractional-reserve banking system,

banks create money.

- The money supply now equals 1800

- The depositor still has 1000 in demand deposits,

- but now the borrower holds 800 in currency.

deposits 1000

reserves 200 loans 800

21

SCENARIO 3 Fractional-Reserve Banking

- Suppose the borrower deposits the 800 in

Secondbank. - Initially, Secondbanks balance sheet is

- But then Secondbank will loan 80 of this deposit

- and its balance sheet will look like this

deposits 800

reserves 800 loans 0

reserves 160 loans 640

22

SCENARIO 3 Fractional-Reserve Banking

- If this 640 is eventually deposited in Thirdbank,

- then Thirdbank will keep 20 of it in reserve,

and loan the rest out

deposits 640

reserves 640 loans 0

reserves 128 loans 512

23

Finding the total amount of money

- Original deposit 1000

- Firstbank lending 800

- Secondbank lending 640

- Thirdbank lending 512

- other lending

Total money supply (1/re ) ? 1000 where re

ratio of reserves to deposits In our example,

re 0.2, so M 5000

24

Money Multiplier and Bank Loans

- Provide an alternative way of describing the

working of the multiplier by showing how

adjustments by banks and the public following an

increase in H produce a multiple expansion of M - A Fed open market purchase increases H, and

increases bank reserves - The bank in which the original check was

deposited has a reserve ratio that is too high

(has excess reserves) ? increase lending - When bank makes loan, person receiving a loan

gets a bank deposit of the amount of the loan ?

money supply has increased by more than the

amount of the open market operation - The expansion of loans (and money) continues

until the reserve-deposit ratio has fallen to the

desired level and the public has achieved its

desired currency deposit ratio

25

Money creation in the banking system

A fractional reserve banking system creates

money, but it does not create wealth bank loans

give borrowers some new money and an equal

amount of new debt.

26

Money Stock Determination

- The Fed has direct control over high powered

money (H) - Money supply (M) is linked to H via the money

multiplier, mm ? Figure shows this relationship - Top of figure is the money stock

- Bottom of figure is the stock of high-powered

money monetary base - Money multiplier (mm) is the ratio of the stock

of money to the stock of high powered money ? mm

gt 1 - The larger deposits are, as a fraction of M, the

larger the multiplier

27

The Money Multiplier

- How much money is eventually created in this

economy? - The money multiplier is the amount of money the

banking system generates with each dollar of

reserves.

28

A model of the money supply

exogenous variables

- money supply, M CU D

- the monetary base, H CU reserves

- controlled by the central bank

- the reserve-deposit ratio, re reserves/D

- depends on regulations bank policies

- the currency-deposit ratio, cu CU/D

- depends on households preferences

29

Money Stock Determination

- Money supply consists of currency, CU, plus

deposits -

(1) - High powered money consists of currency plus

reserves -

(2) - Summarize the behavior of the public, the banks,

and the Fed in the money supply process by three

variables - Currency-deposit ratio

- Reserve ratio

30

Money Stock Determination

- We can rewrite equations (1) and (2) as

- and

- This allows us to express the money supply in

terms of its principal determinants, re, cu, and

H -

(3) - where mm is the money multiplier, given by

-

mm money multiplier or stock of money to the

stock of high-powered money

31

Money Stock Determination

- Some observations of the money multiplier

- The money multiplier is larger the smaller the

reserve ratio, re - The money multiplier is larger the smaller the

currency-deposit ratio, cu - ? The smaller is cu, the smaller the proportion

of H that is being used as currency AND the

larger the proportion that is available to be

reserves

The money multiplier summarizes the total

expansion of money created from a dollar increase

in the monetary base.

32

The Reserve Ratio

- The central bank sets the required reserve ratio

the portion of each deposit commercial banks must

keep on hand - Looking at the money multiplier shown in equation

(3), it is easy to see that the central bank can

increase the money supply by reducing the

required reserve ratio (RRR) - The RRR is not a policy tool of choice as

reserves pay no interest, and thus are an

interest free loan from banks to the central bank - Changes in the RRR have undesirable effects on

bank profits

33

Discussion Question

- What happens to the money supply if you take

Sk100 that you keep under your pillow and deposit

it in a bank with a reserve requirement of 10?

34

Exercise

where

- Suppose households decide to hold more of their

money as currency and less in the form of demand

deposits. - Determine impact on money supply.

- Explain the intuition for your result.

35

Solution to exercise

- Impact of an increase in the currency-deposit

ratio ?cu gt 0. - An increase in cu increases the denominator of

mm proportionally more than the numerator. So mm

falls, causing M to fall too. - If households deposit less of their money, then

banks cannot make as many loans, so the banking

system will not be able to create as much

money.

36

- If the currency-deposit ratio is 23 and the

reserve ratio is 7, the size of the money

multiplier is a. 0.3b. 2.0c. 3.0d. 3.3e. 4.1

37

- If the currency-deposit ratio is 20, the reserve

ratio is 10 and the stock of high-powered money

is H 400, money supply is a. 1,000b. 1,200c.

1,600d. 2,000e. 4,000

38

- If money supply is M 1,200, bank deposits are

D 800 and the monetary base (high-powered

money) is H 480, a. The reserve ratio is 40

and the money multiplier is 4 b. The reserve

ratio is 40 and the money multiplier is

2.5 c. The reserve ratio is 10 and the money

multiplier is 4 d. the reserve ratio is 10 and

the money-multiplier is 2.5 e. the reserve ratio

is 10 and the money multiplier is 1.5

39

- 1. Other things remaining the same, the smaller

the currency-deposit ratio, a. The larger the

reserve ratio b. The smaller the reserve

ratio C. The larger the money multiplier d. The

smaller the money multiplier e. The larger the

monetary base

Quiz 6 Tuesday Seminar

2. If the Fed were to abolish reserve

requirements, a. it could no longer exert any

influence over money supply b. the size of the

money multiplier would become infinite c. The

size of the money multiplier would become

1 d. Both A and B E. None of the above

3. Which of the following functions does money

NOT serve? a. As a unit of account b. As a

standard of deferred payment C. As a protection

against inflation d. As a store of value e. As

a medium of exchange

40

Quiz 6 Wednesday Seminar

- 1. The size of the money multiplier a. Cannot

be influenced by actions of the Fed b. Declines

with a decrease in high-powered

money c. Decreases as the currency-deposit ratio

decreases D. Increases as the reserve ratio

decreases e. Increases as the reserve

requirement is increased

2. Over which of the following does the central

bank have the most control? a. The stock of

moneyB. The stock of bank reservesc. The amount

of excess reserves held by banksd. The size of

the money multipliere. The currency-deposit ratio

3. According to the Baumol-Tobin transaction

demand model, the amount of money balances held

should increase as a. The interest rate

increasesb. The level of income decreasesC. The

cost of money transactions increasesd. The cost

of illiquidity increasese. None of the above