Basic Formula for Federal Income Tax PowerPoint PPT Presentation

1 / 13

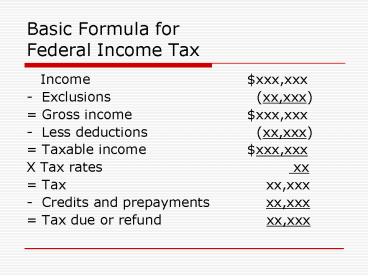

Title: Basic Formula for Federal Income Tax

1

Basic Formula forFederal Income Tax

- Income xxx,xxx

- - Exclusions (xx,xxx)

- Gross income xxx,xxx

- - Less deductions (xx,xxx)

- Taxable income xxx,xxx

- X Tax rates xx

- Tax xx,xxx

- - Credits and prepayments xx,xxx

- Tax due or refund xx,xxx

2

State Local Income Tax

- Most states (43) have income tax

- Some cities (9) have an income tax

- Growing area in tax practice (SALT)

3

Sole Proprietorship

- One-person business

- Income taxed on individual income tax return

- Unlimited liability

4

C Corporations

- One or more owners

- Separate legal entity from owners

- Limited liability

- Tax-paying entity

- Possible double taxation

5

S Corporations

- For all legal purposes, they are corporations.

- For federal income tax purposes, the income is

taxed directly to the owner

6

Partnership

- Two or more partners

- Partnership files separate return (Form 1065)

- Income is taxed pro rata to owners

- Unlimited liability

7

LLCs and LLPs

- One or more owners

- Files partnership return (usually)

- Income is taxed pro rata to owners

- Limited liability!!!!

8

Trusts

- Generally set up by donor to benefit a

beneficiary - Income taxed either to trust or beneficiary

depending on facts - Beyond the scope of Tax I

9

Dealings Between Entity and Owner(s)

- Formation issues

- Operations issues

- Liquidation issues

10

Tax Planning Fundamentals

- Income

- Defer income

- Utilize exclusions

- Utilize lowest tax rates

- Deductions

- Maximize deductions

- Use against highest tax rates

- Credits

11

Factors Affecting the Tax Law

- Economic considerations

- Social considerations

- Equity considerations

- Political considerations

- Influence of the IRS

- Influence of the courts

12

Tax Rates

- Use corporate rates of 15 on first 50,000 and

25 rate on next 25,000 - Assuming X Corporation has 60,000 taxable

income, (1) what is marginal tax rate and (2)

what is average tax rate? (Note tax on 60,000

taxable income is 15 X 50,000 25 X 10,000

10,000)

13

Problem 1-20

- Siennas marginal tax rate is 25

- Corporate bonds pay 8

- Municipal bonds pay 5

- Should Sienna invest in the municipal bond?

- Siennas after tax rate of 75 of 8 6. Dont

invest in the muni bond - Who should invest in the muni bond? Solve for

- (1 MTR) X .08 lt .05

- .08 -.08MTR lt .05

- .03 lt .08 MTR

- .375 lt MTR, or stated as MTR gt .375