Two Liquidation Modes PowerPoint PPT Presentation

Title: Two Liquidation Modes

1

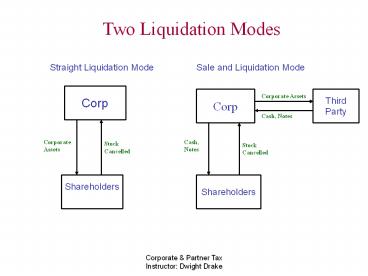

Two Liquidation Modes

Straight Liquidation Mode

Sale and Liquidation Mode

Corp

Corp

Third Party

Corporate Assets

Cash, Notes

Corporate Assets

Cash, Notes

Stock Cancelled

Stock Cancelled

Shareholders

Shareholders

2

Complete Liquidation Shareholder Impact

General Rule Per 331, complete liquidation

treated as sale or exchange of stock, producing

capital gain or loss equal to difference between

cash and FMV of property received and

shareholders basis in stock. Section 301 not

apply. Timing Issues - When did liquidation

began and dividends (non-liquidating)

distributions end. Fact question. Look to

corporate resolutions and adoption of plan. -

453 installment sales treatment applies when

liquidating distributions over time. Open

transaction treatment very risky appears trumped

by 453. - 453 installment treatment permitted

even as to installment obligations acquired by

non-public corp in asset sell-off and distributed

to shareholders. To qualify under 453, corp sale

that created obligation must be with 12 month

period after liquidation plan adopted and

liquidation must be completed within same period.

Inventory and dealer qualify only if part of

bulk sale of assets.

3

Complete Liquidation Corporation Impact

General Rule Per 336, Corp recognizes gain or

loss on property distributed or sold as part of

complete liquidation. 267 related-party loss

limitations not apply in complete liquidation.

(d)(1) Related Party Exception No loss at all

on distribution to related party (per 267) in

complete liquidation if - Distribution

not pro rata, or - Distributed property

acquired by corp in 351 transaction or as

contribution to capital within 5 yrs of

distribution (Disqualified Property). (d)(2)

Tax Avoidance Exception No built-in loss (loss

at time of acquisition) disallowed if property

acquired in 351 transaction or contribution to

capital and principal purpose was to recognize

loss on liquidation. If acquired within 2 yrs of

plan of liquidation, bad purpose a done deal

unless there is clear and substantial

relationship between property and conduct of

business and solid explanation. If outside 2yr

window, probably safe except in most rare

cases.

4

Partnership Liquidation 731 732

731 No gain or loss recognized to partner

unless - Gain to extent money distributed

exceeds partners basis in partnership interest.

- Loss recognized if only money and

unrealized receivables and inventory distributed

to extent basis in partners interest exceeds

amount of money distributed and partnerships

basis in receivables and inventory. - Any

recognized gain or loss is from sale or exchange

of partnership interest. 732(b) If property

distributed to partner in liquidation of

partnership interest, basis in property shall

equal partners interest in partnership less

money receives in distribution. 751(b) Game

Applied full tilt. Note 736 Roadmap not

applicable on complete liquidation.

5

Complete Liquidation Impact on Partnership

General Rule No gain or loss to partnership

on distributions of property to liquidate a

partners interest in partnership. 731(b)

751(b) Impact To extent of 736(b) payments not

reflect partners proportionate share of

unrealized receivables and inventory, deemed

distribution of additional receivables and

inventory to partner followed by partners sales

to partnership for cash. Impact is ordinary

income to partner and increased basis in such

assets to partnership (result of deemed by

back). Partnerships Assets Basis No

change per 734(a) unless 754 election made. If

754 election, basis in capital or 1231 assets (1)

increased by gain recognized by distributee

partner and excess of partnership basis in

distributed property over basis to distributee

under 732 and (d) decreased by loss recognized

by distributee and excess of distributee basis

over partnerships basis. 708 Termination

Liquidation terminates partnership. Also deemed

termination if 50 or more of partners interest

in profits and capital sold within 12 month

period. Old partnership terminated and new

partnership formed. Complete carryovers, but tax

year closed out and new elections.

6

S Corp Complete Liquidation Shareholder Impact

General Rule Per 331, complete liquidation

treated as sale or exchange of stock, producing

capital gain or loss equal to difference between

cash and FMV of property received and

shareholders basis in stock. Note, shareholder

stock basis increased by corporate gain, so often

little or no tax due. Timing Issues - 453

installment sales treatment applies when

liquidating distributions over time. Open

transaction treatment very risky appears trumped

by 453. - 453 installment treatment permitted

even as to installment obligations acquired by

non-public corp in asset sell-off and distributed

to shareholders. To qualify under 453, corp sale

that created obligation must be with 12 month

period after liquidation plan adopted and

liquidation must be completed within same period.

Inventory and dealer qualify only if part of

bulk sale of assets.

7

S Corp Complete Liquidation Corporation Impact

General Rule Per 336, Corp recognizes gain or

loss on property distributed or sold as part of

complete liquidation. 267 related-party loss

limitations not apply in complete liquidation.

Gain or loss passed thru to shareholders. (d)(1)

Related Party Exception No loss at all on

distribution to related party (per 267) in

complete liquidation if - Distribution

note pro rata, or - Distributed

property acquired by corp in 351 transaction or

as contribution to capital within 5 yrs of

distribution (Disqualified Property). (d)(2)

Tax Avoidance Exception No built-in loss (loss

at time of acquisition) disallowed if property

acquired in 351 transaction or contribution to

capital and principal purpose was to recognize

loss on liquidation. If acquired within 2 yrs of

plan of liquidation, bad purpose a done deal

unless there is clear and substantial

relationship between property and conduct of

business and solid explanation. If outside 2yr

window, probably safe except in most rare

cases.