Chapter Five - PowerPoint PPT Presentation

1 / 19

Title:

Chapter Five

Description:

When sale is upstream, beg R/E of sub reflects adjustment. Entry (I) Upstream ... Affects sub income on downstream sale. Individual Consolid Worksheet ... – PowerPoint PPT presentation

Number of Views:13

Avg rating:3.0/5.0

Title: Chapter Five

1

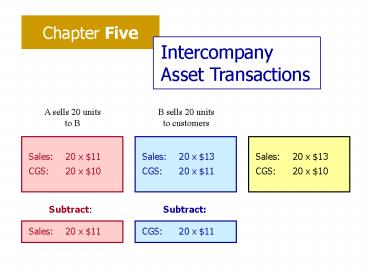

Chapter Five

Intercompany Asset Transactions

A sells 20 units to B

B sells 20 units to customers

Sales 20 x 13 CGS 20 x 10

Sales 20 x 11 CGS 20 x 10

Sales 20 x 13 CGS 20 x 11

Subtract

Subtract

Sales 20 x 11

CGS 20 x 11

2

A sells 20 units to B

B sells 15 units to customers

Sales 15 x 13 CGS 15 x 10 Invnt 5 x 10

Sales 20 x 11 CGS 20 x 10

Sales 15 x 13 CGS 15 x 11 Invnt 5 x 11

Subtract

Subtract

Sales 20 x 11 CGS 5 x 11

CGS 15 x 11

Add

Subtract

CGS 5 x 1

Invnt 5 x 1

3

Prob 5-32

60

How Tall calculates equity earnings of Short

Reported income - Short 40,000 Recog prior yr

unreal gain 5,000 Defer current yr unreal gain

(10,000) Total 35,000 Parents share

(60) 21,000 Extra amortiz (11,000) Equity

earnings of Short 10,000

4

Entry (G) R/E, 1/1/04 5,000 CGS 5,000

To recognize unrealized gain in beginning

inventory.

Entry (S) R/E, 1/1/04 (adj) 345,000 Common

Stock 90,000 Add Pd-in cap 60,000 Invst in

Short 297,000 NC int sub 1/1/04 198,000

5

Entry (A) Equipment 56,000 Buildings 36,000 Da

tabase 56,000 Invst in Short 148,000

Equipment 70,000 2 x 7,000 Buildings 40,000 2

x 2,000 Database 60,000 2 x 2,000

60

6

Entry (I) Equity earn of Short 10,000 Invst

in Short 10,000

Entry (D) Invst in Short 15,000 Dividends

Paid 15,000

7

Entry (E) Oper Exp (deprec) 9,000 Amortiz

Expense 2,000 Equipment 7,000 Buildings 2,00

0 Database 2,000

Entry (P) Liabilities 30,000 Receivables 30,0

00

8

Entry (TI) Revenues 140,000 CGS 140,000

To eliminate intercompany inventory transfers (as

if all of it had been sold).

Entry (G) CGS 10,000 Inventory 10,000

To eliminate unrealized gain in ending inventory.

9

Noncontrolling Interest Entry NCint in Short

Income 14,000 NC int Short 1/1/04 198,000 Divid

ends Paid 10,000 NC int in Short 12/31 202,000

40 x 35,000

Reported income - Short 40,000 Recog prior yr

unreal gain 5,000 Defer current yr unreal gain

(10,000) Total 35,000

10

Upstream Sale

Downstream Sale

- Entry G adjusts subs beginning R/E.

- Entry S reflects this adjustment.

- Entries G G adjusts subs current income.

- Entries C, I, and NCI reflect this adjustment.

- Entry G adjusts parents beginning R/E.

- Entry S is unaffected.

- Entries G G adjusts parents current income.

- Entries C, I, and NCI are unaffected.

11

Downstream 5,000 5,000

Entry (G)

Upstream R/E, 1/1/04 5,000 CGS 5,000

Beg R/E of subsidiary.

Beg R/E of parent.

NOTE For purposes of this class, assume G is

always this entry.

12

Downstream 350,000 90,000 60,000 300,0

00 200,000

Entry (S)

Upsteam R/E, 1/1/04 345,000 Common

Stock 90,000 Add Pd-in cap 60,000 Invst in

Short 297,000 NC int sub 1/1/04 198,000

When sale is upstream, beg R/E of sub reflects

adjustment.

13

Downstream 13,000 13,000

Entry (I)

Upstream Equity earn of Short 10,000 Invst in

Short 10,000

Reported income - Short 40,000 Recog prior yr

unreal gain 5,000 Defer current yr unreal gain

(10,000) Total 35,000 Parents share

(60) 21,000 Extra amortiz (11,000) Equity

earnings of Short 10,000

40,000 . 40,000 24,000

(11,000) 13,000

NOTE There are different approaches to recording

unrealized gains on downstream sales. Regardless

of approach, consolidated totals will be the same.

14

Downstream 16,000 200,000 10,000 206,

000

Noncontrolling Interest Entry

Upstream NCint in Short

inc. 14,000 NCint Short 1/1/04 198,000 Dividends

Paid 10,000 NCint Short 12/31 202,000

40 x 35,000

40 x 40,000

Reported income - Short 40,000 Recog prior yr

unreal gain 5,000 Defer current yr unreal gain

(10,000) Total 35,000

15

Intercompany Transfer of Depreciable Assets

Prob 5-25 Sale of Building

Individual Consolid Worksheet Records Perspect A

djustments

Asset Transfer Equipment 50,000 70,000

20,000 Accum Deprec 0 (40,000) (40,000) Gain on

Sale (20,000) 0 20,000

Entry (TA) Equipment 20,000 Gain on Sale -

Equip 20,000 Accum Deprec 40,000

Affects sub income on upstream sale.

16

Individual Consolid Worksheet Records Perspect A

djustments

During 2003 Accum Deprec (10,000) (6,000) 4,000 De

prec Exp 10,000 6,000 (4,000)

Entry (ED) Accum Deprec 4,000 Deprec

Exp. 4,000

Affects sub income on downstream sale.

17

Individual Consolid Worksheet Records Perspect A

djustments

Start of 2004 Equipment 50,000 70,000

20,000 Accum Deprec (10,000) (46,000) (36,000) R/E

effect - seller (20,000) 0 20,000 R/E effect -

buyer 10,000 6,000 (4,000)

Entry (TA) Equipment 20,000 R/E, 1/1

(seller) 20,000 R/E, 1/1 (buyer) 4,000 Accum

Deprec 36,000

One of these will affect Entry (S).

18

Individual Consolid Worksheet Records Perspect A

djustments

Start of 2004 Equipment 50,000 70,000

20,000 Accum Deprec (10,000) (46,000) (36,000) R/E

effect - seller (20,000) 0 20,000 R/E effect -

buyer 10,000 6,000 (4,000)

Start of 2005 Equipment 50,000 70,000

20,000 Accum Deprec (20,000) (52,000) (32,000) R/E

effect - seller (20,000) 0 20,000 R/E effect -

buyer 20,000 12,000 (8,000)

19

Individual Consolid Worksheet Records Perspect A

djustments

During 2004 Accum Deprec (10,000) (6,000) 4,000 De

prec Exp 10,000 6,000 (4,000)

Entry (ED) Accum Deprec 4,000 Deprec

Exp. 4,000