Is the short course part of a - PowerPoint PPT Presentation

Is the short course part of a

Short Courses GST Classification Flow Chart Note two separate criteria for short courses Is the short course part of a UTS accredited Certificate, Diploma, – PowerPoint PPT presentation

Title: Is the short course part of a

1

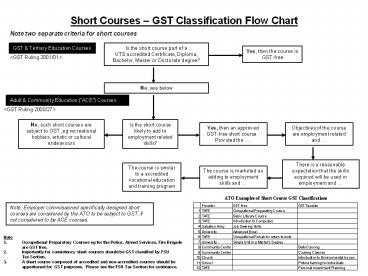

Short Courses GST Classification Flow Chart

Note two separate criteria for short courses

Is the short course part of a UTS accredited

Certificate, Diploma, Bachelor, Master or

Doctorate degree?

GST Tertiary Education Courses

Yes, then the course is GST-free

ltGST Ruling 2001/01gt

No, see below

Adult Community Education (ACE) Courses

ltGST Ruling 2000/27gt

Is the short course likely to add to employment

related skills?

No, such short courses are subject to GST, eg

recreational hobbies, artistic or cultural

endeavours

Yes, then an approved GST-free short course .

Provided the .

Objectives of the course are employment related

and

There is a reasonable expectation that the skills

acquired will be used in employment and

The course is similar to a accredited vocational

education and training program

The course is marketed as adding to employment

skills and

ATO Examples of Short Course GST Classifications

Note, Employer commissioned specifically designed

short courses are considered by the ATO to be

subject to GST, if not considered to be ACE

courses.

- Note

- Occupational Preparatory Courses eg for the

Police, Armed Services, Fire Brigade are GST

free. - 2. Importantly for consistency short courses

should be GST classified by FSU - Tax Section.

- 3. A short course composed of accredited and

non-accredited courses should be apportioned for

GST purposes. Please see the FSU Tax Section for

assistance.

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics, the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.