NGLs PowerPoint PPT Presentation

1 / 128

Title: NGLs

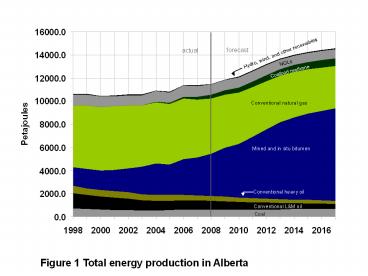

1

NGLs

Coalbed methane

Conventional natural gas

Mined and in situ bitumen

Conventional LM oil

Coal

Figure 1 Total energy production in Alberta

2

Figure 1.1 OPEC crude basket reference price 2007

3

(No Transcript)

4

High

Low

Figure 1.3 Price of WTI at Chicago

5

Figure 1.4 Average price of oil at Alberta

wellhead

6

Figure 1.5 2006 Average monthly reference prices

of Alberta crudes

Figure 1.5 2007 average monthly reference prices

in Alberta

7

(No Transcript)

8

Figure 1.7 Average price of natural gas at plant

gate

9

Figure 1.8 Alberta Wholesale Electricity Prices

10

(No Transcript)

11

Figure 1.10 Canadian economic indicators

12

Figure 1.11 Alberta real investment

Source Statistics Canada, Canadian Association

of Petroleum Producers includes support

activities to mining and oil and gas extraction

13

(No Transcript)

14

Figure 3 Alberta supply of crude oil and

equivalent

15

Figure 4 Total marketable gas production and

demand

Tcf

16

Bitumen - includes producing and evaluation

wells Gas - includes CBM wells Other -

includes unsuccessful, service, and suspended

wells

Figure 5 Drilling Activity in Alberta, 1948-2007

17

EUB Prorationing Plan (restricted production)

Major Oil Field Discoveries 1947 Leduc 1948

Redwater 1949 Golden Spike 1952 Bonnie

Glen 1953 Pembina 1957 Swan Hill 1959 Judy

Creek 1959 Swan Hill South 1965 - Rainbow

Major Events Affecting Price 1973 Oil

Embargo 1979 Iranian Revolution 1980 Iran /

Iraq War 1986 OPEC Crumbles 1990 Gulf

War 1998 Asian Econ. Crisis 2001 9 / 11 2003

Iraq War

Export Pipelines 1950 Interprovincial Pipeline

(Enbridge) 1953 Trans Mountain Pipe Line

1938 - Petroleum and Natural Gas

Conservation Board (EUB) created to enforce

production standards

Source Prices - CAPP Statistical Handbook

Figure 6 Alberta Conventional Crude Oil

Production and Price

18

Alberta Oil Sands Project Startup

Great Canadian Oil Sands (Suncor) Startup

Syncrude Startup

Cdn/cubic metre

Figure 7 Alberta mined bitumen and synthetic

crude oil production and price

19

Cdn/cubic metres

Figure 8 Alberta in situ bitumen production and

price

20

Hurricanes Katerina and Rita hit U.S. Gulf Coast

Foothills Pipe Lines built for gas exports to

California and the mid-western U.S.

Late 1998 Northern Border/TCPL expansion 2000

Alliance Pipeline

1956 TransCanada Pipelines built to take Alberta

gas to central Canada and the U.S. after

debate over its charter in Parliament

PGT expansion

Regulated gas price tied to oil prices. Surplus

built up

Surplus gas drives down prices

Price deregulation

Arbitration awards price increase

Gas prices as a by-product of oil production.

Price less than replacement cost

Figure 9 Historical natural gas production and

price

21

Figure 10 Sulphur closing inventories in Alberta

and price

22

Figure 11 Historical coal production and price

Australian-Japan contract price for thermal coal

(Australian Bureau of Agricultural and Resource

Economics - ABARE)

23

(No Transcript)

24

Figure 2.2 Remaining established reserves under

active development

25

(No Transcript)

26

(No Transcript)

27

(No Transcript)

28

(No Transcript)

29

(No Transcript)

30

Figure 2.8 Alberta crude oil and equivalent

production

31

Production (103 m3/d)

Figure 2.9 Total in situ bitumen production and

producing bitumen wells

32

Peace River OSA

Athabasca OSA

Synthetic Crude Oil

Cold Lake OSA

Figure 2.10 In situ bitumen production by oil

sands area (OSA)

33

Experimental Production

SAGD Production

CSS Production

Synthetic Crude Oil

Primary Production

Figure 2.11 In situ bitumen production by

recovery method

34

Figure 2.12 Alberta crude bitumen production

35

Synthetic Crude Oil

Figure 2.13 Alberta synthetic crude oil

production

36

(No Transcript)

37

(No Transcript)

38

Oil Sands Plants Coke Inventory

Synthetic Crude Oil

Figure 2.16 Alberta oil sands upgrading coke

inventory

39

Nonupgraded bitumen removals from Alberta

SCO removals from Alberta

Synthetic Crude Oil

Alberta demand (mainly SCO)

Figure 2.17 Alberta demand and disposition of

crude bitumen and SCO

40

Figure 3.1 Remaining established reserves of

crude oil

Heavy

Light-medium

41

Figure 3.2 Annual changes in conventional crude

oil reserves

42

Figure 3.3 Annual changes to waterflood reserves

43

Remaining reserves (103m3)

Total number of pools (103m3)

Initial reserves (103m3)

Figure 3.4 Distribution of oil reserves by size

44

Figure 3.5 Oil pool size by discovery year

45

(No Transcript)

46

Figure 3.7 Geological distribution of reserves of

conventional crude oil

47

(No Transcript)

48

Figure 3.9 Albertas remaining established oil

Reserves versus cumulative production

49

(No Transcript)

50

(No Transcript)

51

(No Transcript)

52

(No Transcript)

53

PSAC 8

PSAC 7

PSAC 5

PSAC 4

PSAC 3

PSAC 2

PSAC 1

Figure 3.14 Conventional crude oil production by

modified PSAC area

54

Figure 3.15 Total crude oil production and

producing wells

55

(No Transcript)

56

Figure 3.17 Crude oil well productivity in 2007

57

6

of total production from oil wells

10

8

6

6

4

4

5

2

3

47

Figure 3.18 Total conventional crude oil

production by drilled year

58

Texas onshore

Alberta crude oil

Louisiana onshore

Figure 3.19 Comparison of crude oil production

59

Figure 3.20 WTI crude oil price and well activity

60

Heavy

Light-medium

Figure 3.21 Alberta daily production of crude oil

61

Figure 3.22 Capacity and location of Alberta

refineries

62

Crude oil removals from Alberta

Alberta demand

Figure 3.23 Alberta demand and disposition of

crude oil

63

Figure 3.24 Alberta supply of crude oil and

equivalent

64

Figure 3.25 Alberta crude oil and equivalent

production

65

(No Transcript)

66

(No Transcript)

67

(No Transcript)

68

(No Transcript)

69

(No Transcript)

70

actual forecast

Figure 4.6 Coalbed methane production forecast

from CBM wells

71

Figure 5.1 Annual reserves additions and

production of conventional marketable gas

72

Figure 5.2 Remaining conventional marketable gas

reserves

73

Figure 5.3 New, development, and revisions to

conventional marketable gas reserves

74

(No Transcript)

75

Total number of pools (106m3)

Remaining reserves (109m3)

Initial reserves (109m3)

Figure 5.5 Distribution of conventional gas

reserves by size

76

Figure 5.6 Conventional gas pools by size and

discovery year

77

Figure 5.7 Geological distribution of

conventional marketable gas reserves

78

Figure 5.8 Remaining conventional marketable

reserves of sweet and sour gas

Sweet natural gas

Sour natural gas

79

Figure 5.9 Expected recovery of conventional

natural gas components

80

(No Transcript)

81

Figure 5.11 Conventional gas ultimate potential

82

(No Transcript)

83

Figure 5.13 Conventional gas in place by

geological period

84

(No Transcript)

85

Figure 5.15 Successful conventional gas wells

drilled and connected

86

(No Transcript)

87

(No Transcript)

88

of total production

2

4

3

11

4

20

41

6

9

Figure 5.18 Marketable gas production by modified

PSAC area

89

Figure 5.19 Conventional marketable gas

production and number of producing wells

90

(No Transcript)

91

(No Transcript)

92

Figure 5.22 Natural gas well productivity in 2007

93

of total production from gas wells

3

Connection year

Figure 5.23 Raw gas production by connection year

94

Figure 5.24 Raw gas production of sweet and sour

gas

95

US total production

Texas onshore

Louisiana onshore

Alberta

Figure 5.25 Comparison of raw natural gas

production

96

Figure 5.26 Average initial natural gas well

productivity

in Alberta

97

Figure 5.27 Alberta natural gas well activity and

price

98

Figure 5.28 Conventional marketable gas production

99

Figure 5.29 Gas production from bitumen upgrading

and bitumen wells used for oil sands operations

100

Figure 5.30 Total gas production in Alberta

101

Figure 5.31 Alberta natural gas storage

injection/withdrawal volumes

102

(No Transcript)

103

(No Transcript)

104

Figure 5.34 Alberta marketable gas demand by

sector

105

Figure 5.35 Historical volumes available for

permitting

106

forecast

actual

In Situ Cogeneration

In Situ

Mining and Upgrading Cogeneration

Mining and Upgrading

Figure 5.36 Purchased natural gas demand for oil

sands operations

107

Purchased gas

Produced gas from bitumen

Process gas from upgrading

Figure 5.37 Gas demand for bitumen recovery and

upgrading

Does not included process gas for electricity

generation.

108

Figure 5.38 Total Purchased, Process and

Produced Gas for Oil Sands Production

109

Figure 5.39 Total marketable gas production and

demand

Tcf

110

Figure 6.1 Remaining established NGL reserves

expected to be extracted from conventional gas

and annual production

111

Figure 6.2 Remaining established reserves of

conventional natural gas liquids

112

(No Transcript)

113

Figure 6.4 Ethane Supply and Demand

114

Actual Forecast

103m3/d

excludes solvent flood volumes

Figure 6.5 Propane supply from natural gas and

demand

115

Actual Forecast

103m3/d

excludes solvent flood volumes

Figure 6.6 Butanes supply from natural gas and

demand

116

Actual Forecast

Demand met by alternative sources and types of

diluent

103m3/d

excludes solvent flood volumes

Figure 6.7 Pentanes plus supply from natural gas

and demand for diluent

117

Refining and upgrading

Sour gas

Figure 7.1 Sources of sulphur production

118

Figure 7.2 Sulphur production from gas

processing plants in Alberta

119

Figure 7.3 Sulphur production from oil sands

120

Figure 7.4 Canadian sulphur offshore exports

121

Figure 7.5 Sulphur demand and supply in Alberta

122

(No Transcript)

123

Figure 8.2 Alberta marketable coal production

124

Figure 9.1. Alberta electricity generating

capacity

125

Figure 9.2. Alberta electricity generation

126

Figure 9.3. Alberta electricity transfers

127

Figure 9.4. Alberta electricity consumption by

sector

128

9.5. Alberta oil sands electricity generation and

demand

Industrial oil sands historical data on

electricity demand was estimated using an

assumption of 10 kWh/bbl for thermal in situ oil

sands projects that do not operate cogeneration

units.