Syllabus: - PowerPoint PPT Presentation

Title:

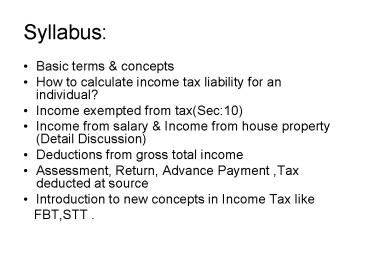

Syllabus:

Description:

Syllabus: Basic terms & concepts How to calculate income tax liability for an individual? Income exempted from tax(Sec:10) Income from salary & Income from house ... – PowerPoint PPT presentation

Number of Views:149

Avg rating:3.0/5.0

Title: Syllabus:

1

Syllabus

- Basic terms concepts

- How to calculate income tax liability for an

individual? - Income exempted from tax(Sec10)

- Income from salary Income from house property

(Detail Discussion) - Deductions from gross total income

- Assessment, Return, Advance Payment ,Tax deducted

at source - Introduction to new concepts in Income Tax like

- FBT,STT .

2

Basic concepts under income tax Act Sec2

- Previous Year The year in which income is earned

is called as previous year. - Assessment year the income of the previous year

is charged in the next year called as assessment

year. - Example X joins an Indian company on January

23,2007.Prior to January 23,2007,he is not in

employment, What is the previous year for the

assessment year 2007-08 2008-09?

3

Assessee

- Assessee means a person by whom any Tax or any

other sum of money(i.e Penalty or interest) is

payable under the actsec2(7)

4

Who is liable to pay Tax?

- A person is liable to pay Tax.

- Sec2(31) of the act defines the person.

- The person includes

- An Individual

- A Hindu undivided family

- A company

- A Firm

- An association of persons or body of individuals

whether incorporated or not - A local Authority

- Every artificial juridical person

5

Example

- Determine the status of the following

- Pune university

- DCM Ltd

- Mumbai municipal corporation

- Taxman publications Ltd

- Laxmi commercial bank

- XYCO.,Firm of XY

- Joint family of X,Mrs. X their sons A B

6

Heads of Income

- There are 5 heads of Income

- Income from Salary

- Income from house property

- Income from profits gains of business

- Income from other sources

- Capital gains short term long term capital

gain.

7

What constitutes salary

- There are 3 groups that constitute your salary

- Group 1 Basic salary, advance salary, arrears of

salary, all types of bonus, service award

,pension - Group 2Allowances group It includes dearness

allowance, conveyance allowance, children

education allowance, overtime allowance, leave

travel allowance, city compensatory allowance - Group 3 Perquisites It means facilities given

by Employer to Employee Rent free

accomodation,domestic servant facility,

reimbursement of medical facility,Motar car

facility, benefits derived by stock option scheme.

8

Exemption limit for certain items of salary

allowances

- Leave salary or Leave encashment(sec10(10AA)

- Leave salary is the salary i.e received at the

time of retirement or termination of service is

exempt to the extent of following For central or

state government employees the entire amount is

tax free, for other employees the least of

following is exempted from tax - Leave salary actually received

- Ten months average salary

- Amount specified by government i.e Rs.3,00,000

- Cash equivalent to earned leave not exceeding 30

days for each year of completed service. In all

cases salary means salary dearness allowance

9

Example of leave encashment

- Mr.X is an employee of Y ltd.receives 80,000 as

leave salary at the time of his retirement on

Feb,2006. average salary drawn during last 10

months Rs.3,000. Duration of service is 24 years,

leave taken in service is 9 months. Leave

entitlement as per employers rule is one month

for each completed year of service. - Calculate Taxable leave salary for Mr.X?

10

Calculation for leave salary

- Cash equivalent of leave at the time of

retirement300015 months(24-9)45,000 - 10 months average salary10300030000

- Amount notified by government3,00,000

- The least of above 3 i.e. Rs.30,000 will be

deducted from actual leave salary received. It

means taxable salary would be Rs.50,000(80,000-30,

000)

11

Gratuity

- Gratuity received by the employee of central or

state government local authority is exempt

without any limit. - Gratuity received under payment of gratuity act

is exempt to the extent it does not exceed 15

days wages for every year of completed service to

a maximum of Rs.3,50,000 - When the employee is not covered by payment of

gratuity act, It is average salary for each year

of completed service subject to a maximum of

Rs.3,50,000

12

Employee covered by payment of gratuity act

- Example An employee receives gratuity

Rs.1,80,000 as gratuity on his retirement. Period

of service is 36 years 4 months. The last drawn

salary were Rs.7,800.The amount of gratuity

exempt shall be minimum of (a), (b) (c) - Gratuity actually received Rs.1,80,000

- Amount calculated on the basis of 15 days salary

for completed year of service(780015/2636)1,62

,000 - Maximum amount of gratuity Rs.3,50,000

- Thus, Rs.1,62,000 shall be exempt Rs.18,000

will be taxable.

13

Employee not covered under payment of gratuity

act

- An employee receives Rs.3,20,000 as gratuity on

his retirement Period of salary is 40 years.

Average salary in the immediately preceding 10

months is Rs.12,600 per month. The amount of

gratuity exempt will be as follows - Actual amount received Rs.320,000

- ½ month average salary for 40 completed

years(12,600/240)Rs.2,52,000 - Maximum monetary limit Rs.3,50,000

- Thus Rs.

- 2,52,000 is exempt Rs.68,000 is taxable.

14

Compensation received under VRS

- Under the approved VRS, the maximum exemption is

Rs.5,00,000.

15

Deduction from salary

- Conveyance allowance is Rs.800 per month is

exempted from tax. - Pension can be commuted pension or it can be

un-commuted pension. Un-commuted pension refers

to pension received periodically to the employee.

Commuted pension means lump sum amount received,

it is tax free for government employees, for non

government employees 1/3rd amount is tax free if

the employee is in receipt of gratuity otherwise

½ of the amount is exempted from tax.

16

Allowances

- Allowances referred to the fixed quantity of

money given regularly in addition to salary for

meeting a particular requirement connected to

services rendered by the employee. It is fixed,

predetermined given irrespective of actual

expenditure. It is based on due or receipt basis

whichever is earlier.

17

Allowances which are fully taxable

- Dearness allowance

- City compensatory allowance

- Medical allowance

- Lunch/Tiffin allowance

- Overtime allowance

- Servant allowance

- Warden allowance

- Family allowance

18

Allowances exempted in case of certain persons

- Allowances to a citizen of India who is

government employee rendering services outside

India - Allowances to HC SC judges

- Allowances received by employee of UNO from his

employer

19

House Rent Allowance

House is in (D,K,M,C) House is any other city

Allowance actually got Allowance actually got

Rent pd in excess of 10 of salary Rent pd in excess of 10 of salary

50 of salary 40 of salary

- House Rent allowance This allowance is taxable

if an Assessee lives in his house or in the house

for which he does not pay any rent otherwise the

exemption limits are as follows Least of 3 is

exempted from Tax.

20

Example for calculating HRA

- Mr. Z staying in Chennai receives Rs.12500 as

basic salary, Rs.1,500 as D.A. commission

Rs.60,000 P.A.Total salary Rs.2,28,000. House

rent paid by him Rs.2,500 p.m. H.R.A. per month

is Rs.1800 per month. Calculate taxable H.R.A.

Excess of rent paid over 10 of

salary7200(30000-22800) - 50 of salary i.e Rs.1,14,000,Actual HRA recd.

Rs.21,600. Therefore exempted HRA will be least

of 3 i.e Rs.7200 .

21

Perquisites which are taxable in the hands of all

employees

- Rent free accommodation at concessional rate

- If the accommodation is provided by the employer

which is owned by the Employer,20of salary

during which accommodation was occupied by the

employee is the value of taxable perquisite - If accommodation is taken on lease or rental the

actual amount of rent paid by the employer or 20

of salary whichever is less is the value of

perquisite. - For exampleMr. X is a regular employee in A ltd.

With effect from December 1 ,2006 ,Mr. X provided

unfurnished flat for which Employer is paying

rent of Rs.7500 per month. Salary earned during

this period by Mr. is Rs.55,520. Calculate

taxable value of this perquisite? (Ans11,104)

22

Valuation for furnished accommodation

- If the accommodation is furnished perquisite

value of such accommodation is to be increased by

the value which is equal to 10per annum of the

cost of furniture. - Example In the same example if the furniture is

also provided by the employer the cost of which

is equal to Rs.36000. calculate the value of

furnished accommodation.(ans12,304)

23

Perquisites

- If accommodation is provided in a Hotel, it is

24 of salary or actual hotel charges whichever

is less. - For example Mr. X is a managing director of

ABC(P) Ltd. Salary for the purpose of calculating

taxable perquisite Rs.1,79,000. Rent paid for

hotel accommodation is Rs.1,20,000. Calculate

Taxable value of this perquisite - The value is nil if the accommodation is provided

only for 15 days on transfer of employees from

one place to another. - Accommodation provided at specified remote area

or mining site or oil exploration, project

execution site, dam site ,power generation site.

24

Perquisites

- Monetary obligation of employee discharged by the

employer is taxable to the extent of actual

amount spent by the employer. - e.g. Gas, Electricity bill, children education

exp. - Life insurance paid by the Employer is Taxable to

the extent of actual amount spent by the Employer.

25

Perquisites

- Interest free or concessional loans

- If the loan is given to the Employee only to the

extent of rs.20,000 there is no tax liability. - If loan is applied to specified diseases, the

perquisite value is nil. - In any other case for valuation purpose, interest

rate applicable by SBI for that previous year on

the maximum outstanding monthly balance

interest recovered from customers.

26

Perquisites (illustrations)

- Determine the taxable value of perquisites in the

following cases - X is employed by A ltd. On June06,the company

gives an interest free loan of Rs.14,00,000

repayable in 5 yrs. The lending rate of SBI for

similar loans8.5 per annum(ans99167) - C ltd. gives the following interest free loans to

Z an employee of the company-Rs.15,000 for a

child's education Rs.5,000 for the purchase of

refrigerator. No other loan is given to C ltd. - Y is employed by B Ltd. On April 1,2006,he takes

a personal loan of Rs.25,000 from B Ltd. B Ltd.

recovers interest _at_ 7p.a. Lending rate of SBI

for similar loans is 12.5.(ansRs.1438)

27

Perquisites

- Use of movable Assets

- Use of Laptop computer value is Nil

- In case of any other Asset 10per annum of the

value or the actual rent paid by the Employer.

28

Taxable Perquisites for movable Property

- Calculate the value of taxable perquisites in the

following cases - Mr. X is given laptop by the employer company for

office private purpose. cost of the laptop to

the Employer is Rs.96,000. - On Oct 15,2006 the company give its Music System

to Y for domestic use. (Ownership is not

transferred) Cost of the music system to the

Employer is Rs.15,000.

29

Transfer of movable assets

- Movable assets belonging to Employer transferred

to Employee valuation is as under - Computer Electronic items Actual cost to the

Employer-50 cost for each year of completed

service on W.D.V. basis less any amount

recovered from employee. - Motor car Actual cost to the Employer-20 for

each year of completed service on W.D.V basis

less any amount recovered from employee. - Any other Asset Actual cost to the

Employer-10of cost for each year of completed

service based on SLM less any amount recovered

from Employer.

30

Perquisites which are Taxable in the hands of

specified Employees

- Who is specified Employee?

- Employee comes under the following category

- He is Director of the company

- He is having substantial interest in the working

of the company. i.e 20 or more voting power - His income from Salary from one or more Employer

excluding all the benefits provided by way of

monetary payment exceeds Rs.50,000

31

Taxable Perquisites Specified Employees

- Provisions by Employer of services of a

sweeper,gardner,watchman or personal attendant.

Value Actual cost to employer - Supply of gas, electricity or water for household

consumption Value is equal to - (a) From own source valueMfg.cost per unit

- (b) In any other case value paid by employer

32

Taxable Perquisites

- Free or concessional education facility to any

member of Employee - Educational Institute owned maintained by

Employer - ValueCost of education in similar institute in

nearby locality - Value Nil up to 1000 p.m. per child of employee

(not others)

33

Tax Free Perquisites( For all employees)

- Medical treatment to employee or his family

member in a hospital maintained by the Employer. - Reimbursement of Medical treatment of Employee or

his family members up to Rs.15,000 - Health Insurance paid by employee under a scheme

approved by GIC - Any Food or beverages provided by Employer in

office or factory or through paid vouchers which

are not transferable.

34

Tax free perquisites for all employees

- Perquisites which are payable by govt to its

employees for rendering services outside India. - Rent free house /conveyance facility to H.C.

S.C.Judges. - Residence provided to officer of parliament,

union Minister or Leader of opposition in

Parliament - Employers contribution to Pension policy,

deferred annuity, staff group insurance plan - Accident insurance policy premium paid by the

Employer - Recreation facility to all Employees.

35

Following perquisites are tax free but subject to

FBT

- Conference cost includes tour travel hotel exp.

Relating to conference(30 0f 20 0f the value) - Use of Health/sports club provided by

Employer(30 0f 50 0f the value) - Expenses on Telephones (incl. mobiles) by

Employer(30 of 20 of the value)

36

- ANY OTHER INDIVIDUAL BELOW 65 YEARS AGE

- RATES OF INCOME-TAX

- A. Normal Rates of tax

- Where the total income does not exceed

Rs.1,00,000/-. - Nil

- 2. Where the total income exceeds Rs.1,00,000 but

does not exceed Rs.1,50,000/-. - 10 per cent, of the amount by which the total

income exceeds is.1,00,000/- - 3. Where the total income exceeds Rs.1,50,000/-

but does not exceed Rs.2,50,000/-. - Rs.5,000/- plus 20 per cent of the amount by

which the total income exceeds Rs.1,50,000/-. - 4. Where the total income exceeds Rs.2,50,000/-.

- Rs.25,000/- plus 30 per cent of the amount by

which the total income exceeds Rs.2,50,000/-.

37

Resident Women below 65 years age

- B. Rates of tax for a woman, resident in India

and below sixty-five years of age - 1. Where the total income does not exceed

Rs.1,35,000/-. - Nil

- 2. Where the total income exceeds Rs.1,35,000 but

does not exceed total income exceeds

Rs.1,50,000/-. - 10 per cent, of the amount by which the

Rs.1,35,000/- - 3. Where the total income exceeds Rs.1,50,000/-

but does not exceed Rs.2,50,000/-. - Rs.1,500/- plus 20 per cent of the amount by

which the total income exceeds Rs.1,50,000/-. - 4. Where the total income exceeds Rs.2,50,000/-.

- Rs.21,500/- plus 30 per cent of the amount by

which the total income exceeds Rs.2,50,000/-.

38

- C. Rates of tax for an individual, resident in

India and of the age of sixty-five years or more

at any time (Senior citizen) - during the financial year

- Where the total income does not exceed

Rs.1,85,000/-. - Nil

- 2. Where the total income exceeds Rs.1,85,000 but

does not exceed Rs.2,50,000/-. - 20 per cent, of the amount by which the total

income exceeds Rs.1,85,000/- - 3. Where the total income exceeds Rs.2,50,000/-.

- Rs.13,000/- plus 30 per cent of the amount by

which the total income exceeds Rs.2,50,000/-. - Surcharge on income tax

- The amount of income-tax computed in accordance

with the preceding provisions of this paragraph

shall be increased - by a surcharge at the rate of ten percent of such

income tax where the total income exceeds ten

lakh rupees. - additional surcharge ( Education Cess on Income

Tax) at the rate of two percent of the income-tax

and surcharge.

39

Deduction under CH.VI-A

- Deduction under CH.VI-A are not allowed for the

following incomes - Long Term Capital Gain

- Short term capital gain on securities for which

STT is paid - Winning from Lotteries

- Deduction is not allowed if GTI is nil.

40

Deduction under Sec80C

- Allowed to Individuals HUF

- Maximum deduction allowed is rs.1,00,000

- Tuition fees paid for children

- Subscription to any units of Mutual fund

mentioned u/s10(23D) - Repayment of housing loan (principal Amount)

- Subscription to Equity Debentures for

infrastructure company. - Notified deposit scheme of public sector company

providing long term finance for housing - Contribution to NSC,NSS,PPF

41

Deduction under Sec80C

- Payment to notified annuity plan of any insurance

company - Term deposit equal to 5 years or more in

accordance with a scheme framed by the

Government. - Life insurance premium maximum 20 of policy

which is for self /spouse/any child. - For participation in unit linked insurance plan

- Employees contribution to statutory fund

42

Example

- X (age 42 years ) is a salaried employee (salary

being Rs 40,000 per Month) during the previous

year 2006-07, he makes the following investment

deposits or payments - Life insurance premium on life of his married

daughter Rs 6,000 Sum assured Rs 20,000) - Life insurance premium on his own life Rs 2,700

(sum assured 60,000) - Life insurance premium on the life of his

dependent sister Rs 10,000 - Contribution towards recognized PF Rs 9,000

- Contribution towards PPF Rs 30,000

- Repayment of lone taken from LIC for purchase of

residential house property Rs 30,000 - Contribution towards notified equity Linked

saving scheme of UTI (i.e. MEP 2007 - Rs 14,000 - Find out the tax liability of X for the

assessment year 2007-08 assuming that income from

house property is 18,000/-

43

Find out the Tax Liability in the cases given

below for assessment year 2007-08

X Y Z A

Age 42 31 25 55

Gross Total Income 260000 196000 310000 426000

Investment Contribution for deduction under 80C

Public Provident Fund - 70000 50000 40000

Recognized Provident Fund - 40000 16000 6000

Notified Equity Linked Saving scheme MEP 07 - - 15000 15000

Notified bonds of Infrastructure company 100000 - 26000 2000

44

Sec80CCC Sec80CCD

- Sec80CCC 80 CCD are meant for pension policy.

- Section 80CCC for the contribution towards

pension fund set up by the private organization. - Section 80CCD is pension scheme to new Entrants

to Government Service. As per the scheme it is

mandatory for every person entering the service

of Central Government on or after Jan.1,2004 to

contribute 10 of salary every month towards

their pension account - The aggregate amount of deduction under section

80C,80CCC80CCD cannot exceed Rs.1,00,000.

45

Sec 80D Medical Insurance in

- Insurance premium paid by the Taxpayer in

accordance with the scheme framed in this behalf

by central government. The scheme is known by the

name of Mediclaim insurance policy. Amount

deposited under a similar scheme of any other

insurer who is approved by IRDA shall be eligible

for deduction. - This premium is paid by cheque.

- If all the conditions are satisfied ,deduction is

equal to insurance premium actually paid or

Rs.10,000 whichever is less.

46

Deduction under Sec80DD

- Deduction is available for the amount incurred or

amount deposited under any scheme framed by LIC

or any other insurer for the purpose of medical

treatment of dependent. - If it is minor disability deduction is available

for the fixed amount which is equal to Rs.50,000

for the severe disability the deduction

available is equal to Rs.75,000. - Sec80DDB is for medical treatment of specified

disease maximum to the extent of rs.40,000.

47

Deduction under sec80E

- Deduction is available for an individual who has

taken loan for the purpose of higher education

for any full time graduation or post graduation

course. - Deduction is available for the interest amount

paid on Loan.

48

Illustration for deduction under Sec80E

Particulars Loan 1 Loan 2 Loan 3

For whom education loan is taken X X Daug of X

Purpose of Loan

Amount of Loan 6L 3L 5L

Annual repayment of Loan during the period 1L 0.5L 1L

Annual payment of interest during the previous year 0.6 0.3 0.55

Find out the amount of deduction under sec80E for assessment year 2007-08 Find out the amount of deduction under sec80E for assessment year 2007-08

49

Donations U/S 80G

- It is for different types of Donation. This

deduction is available when proof of Donation is

attached with the return. - The amount of donation should not exceed 10 of

adjusted total income of the business except the

donation which is eligible for 100 donation

under this section. - Adjusted income is after considering the

deductions u/s 80C to 80U

50

Deduction under Sec80GG

- The tax payer is an individual not getting any

HRA from the company or he is a self employed

person. - The deduction will be least of the following

- Rs.2,000 per month

- 25 of total income

- The excess of 10 of total income.

51

Deduction U/S 80U

- Person with physical disability

- For severe disability deduction is available for

a fixed amount of Rs.75,000 or Rs.50,000. - The assessee has to give a certificate by the

Medical authority. - If assessee is claiming deduction u/s 80U , the

person on whom he is dependant should not claim

any deduction under sec80DD

52

Income from House Property

- If the property is self occupied annual value of

this property is NIL. - If the property is purchases after 1.4.99, if

the loan is taken for the purchase construction

of house property , deduction is available for

the interest amount to the extent of Rs.150,000 .

For the principal amount individual will get

deduction u/s80C - In case of repairs of self occupied property

deduction is available to the extent of Rs.30,000

53

If the house property is let out..

- Gross annual value of the property is the actual

amount of rent received or the standard rent

given under rent control act or fair rent

whichever is high. - From this gross value municipal taxes paid are

deducted. - From net annual value Repairs deduction is equal

to the 30 of the value Interest on borrowed

capital is allowed maximum to the extent of

Rs.30,000 for let out property.

54

Short term Long term capital gain

- Short term capital gain on transfer of equity

shares or units of an equity oriented mutual fund

on or after 1.10.2004 i.e., the date on which

security transaction tax has come into force

shall be subject to a flat rate of 10 u/s 111A. - Long term capital gain on transfer of equity

shares of a company or units of equity oriented

fund arising on or after 1.10.2004 subject to

security transaction tax is fully exempted u/s

10(38)

55

Example

- Mr. X is Assistant Manager in a leasing co. at

Delhi has the following incomes, expenses

investments during 2006-07. Calculate his taxable

income tax payable - (a) Gross Salary Rs.2,30,000 (b) Rent for

commercial house property Rs.51,000,house tax

paid during the period is Rs.4,000 (c) The

assessee has self occupied property, Interest on

this loan is Rs.31,000 availed in March,98.

56

Example.

- (e) Sale consideration for shares sold during the

period is Rs.2,00,000(cost of acquisition in June

2003Rs.84,740)(f) short term capital gain Rs.5000

on which security transaction tax paid is

0.125(g) Interest on debenturesRs.3,000 - (h) Bank Interest/post office monthly income

Rs.12,000(i)Dividends from UTIRs.4,000(j)int on

relief bond tax free)Rs.5,400(k)dividend on

shares in companies rs.5,000 (l) Premium on life

insurance policy, contribution to PF, Repayment

of housing loan total Rs.1,00,000.

57

Compulsory filing of return under one by six

scheme

- Person residing in a specified area fulfilling

one of the following six criteria's shall liable

to pay income tax return - Occupying an immovable property exceeding

specified floor area. - Owner or Lessee of a 4 wheeler motor vehicle

- Subscriber to a cellular phone

- Incurred expenditure for foreign tour for himself

or any other person. - Holding a credit card

- Holding membership of a club for membership fee

is Rs.25,000 - Incurred expenditure Rs.50,000 or more towards

electricity.

58

Time for filing of return(due dates)

1 Companies 31st October

2 Assessee other than company whose

accounts are required to be audited uner i

income tax act or any other law 31st October

3 A working partner of a firm whose accounts

are required to be audited 31st October

4 Assessee other than company covered under Assessee other than company covered under

one by six scheme 31st October

5 all other assessee 31 st July

59

Annual Information Return form 65

Sr no Nature value of transactions Persons responsible for furnishing A.I.R.

1 Cash Deposit of Rs.10,00,000 or more in a year in a saving account Bank

2 Payment of credit card holder of Rs.2,00,000 or more during in a year Bank, company, institution issuing such credit card

3 Receipt from any person of Rs.2,00,000 for acquiring units of a mutual fund Trustee, authorised person of mutual fund

60

Annual Information Return.

Receipt from any person Rs.5,00,000 for or more for acquiring shares Company, Institution issuing bonds acquiring bonds or debentures

Receipt from any person of 100000 or more for acquiring shares Company issuing shares through Public/ right issue

Purchase or sale of immovable property of Rs.30,00,000 or more Registrar / Sub Registrar

Receipts from any person of Rs 500000 or more in a year for acquiring RBI Bonds Authorized Person of RBI bonds

61

Advance Tax

- All assessee including salaried Employees if tax

payable by the person (after deducting

rebates,TDS,Deduction) exceeds Rs.5,000.

62

Advance Tax Installments due dates

Due date for payment of Advance Tax For non company For company assessee

By 15 th June Nil 15 of advance tax

By 15 th Sept 30 of advance tax 30 of advance tax

By 15th December 30 of advance tax 30 of advance tax

By 15 th March 40 of advance tax 25 of advance tax

63

Tax Deducted at Source

- Tax deducted at source means before getting any

source of income tax is deducted on such

payments. - Following persons are liable to deduct tax at

source - Individuals (incl.sole proprietary concern) HUF

carrying the business or profession whose

turnover exceeds Rs.40 lacs or 10 lacs if it is

income from Profession.

64

Payment on which tax is to be deducted at Source

Name of the payment How tax is deducted at source

Salary Sec192

Interest on securities If it exceeds Rs.2,500 TDS is 10.2

Interest on time deposits If it exceeds Rs.5,000 TDS is 10.2

Winning from lotteries 30.6 if it exceeds Rs.5000

Insurance Commi. 10.2

65

Tax deducted at source

Payment to advertising ag. 1.02

Payment to Contractor 2.04

Payment to sub contractor 1.02

Payment of repurchase of units under ELSS 20..4

Payment on withdrawal from NSS 20..4

Payment of rent to any person other than ind,huf 20..4