Seitel - PowerPoint PPT Presentation

Title:

Seitel

Description:

Oil and Gas Exploration (16% of revenues) Basic Stock Statistics. Exchange: NYSE. Beta: 0.85 ... DDD Energy: wholly owned exploration and production subsidiary. ... – PowerPoint PPT presentation

Number of Views:294

Avg rating:3.0/5.0

Title: Seitel

1

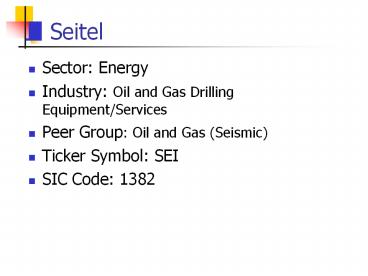

Seitel

- Sector Energy

- Industry Oil and Gas Drilling Equipment/Services

- Peer Group Oil and Gas (Seismic)

- Ticker Symbol SEI

- SIC Code 1382

2

Seitel (SEI) Business Description

- Seismic Data (84 of revenues)

- Provides seismic data and analysis services used

in oil and natural gas exploration. - Owns the largest seismic data library in USA.

- Markets this data to more than 400 oil and gas

companies under license agreements. - Extensive data for North America, and also for

the North Sea. - Oil and Gas Exploration (16 of revenues)

3

Basic Stock Statistics

- Exchange NYSE

- Beta 0.85

- 52-Week Range

- 8.88 to 23.03

- Recent price 8.88

- Shares outstanding 25M

- Market Cap 294M

- PE/G 0.41

- Valuation ratios

- P/E(ttm) 10.2

- P/S(ttm) 1.49

- P/B(mrq) 0.96

- P/CF(ttm) 2.61

- 2000 Rev 163.8M

- 2000 NI 23.9M

- 2000 Assets 578M

- Institutions own 74

- Officers and Directors own 13.4

4

Recent Significant Developments

- June 25, 2001

- Bought back 100,000 shares

- March 28, 2001

- Purchases 1300 square miles of US onshore 3D

seismic data from Grant Geophysical - Jan. 17, 2001

- Purchases all rights to Lacey Digital

Transcription software, the pre-eminent product

for seismic data capture. - Sept. 2000

- Announces plan to allow client access of seismic

data via the Internet.

5

Recent Significant Developments

- August 14, 2001

- Q2 2001 Revenue Up 8, First Six Months Revenue

Up 35, Over 2000 Results - Q2 earnings were up 12 over same quarter a year

earlier. - However, earnings were only 0.22/sh versus

expected 0.30/sh. - Due to much lower earnings from Canadian

subsidiary. Head of that subsidiary was

terminated and replaced.

6

Industry Outlook-Oil and Gas (Drilling and

Equipment)

- Got off to slow start after tremendous

performance in 2000. - Has dropped sharply in 2001 due to worries about

slowed economies and declining natural gas

prices. - Domestic drillers should benefit due to Bush

administration. - How affected by current crisis?

- National security concerns domestic drilling

will get a boost? - Worldwide demand for oil will plummet, so prices

will collapse? - Energy demands by military at war will be huge?

7

Industry Outlook-Oil and Gas (Drilling and

Equipment)

- Energy sector boom from 1972-81, bust from

1982-95, present boom started in 1996 with

interruption by Asian economic crisis in 1997-98. - Outdated energy infrastructure that needs to be

updated and expanded.

8

Seitel (SEI) Where Will Growth Come From?

- More oil companies are starting to realize the

cost savings of outsourcing their seismic work. - Seitel only does seismic work and can do it

better and cheaper. - Previously, big oil companies only recovered the

most economical 40 of oil from each discovery. - The remaining oil is recovered by smaller

drillers when oil prices are high enough. - Now, new accurate 3D seismic images have allowed

the recovery of more oil at lower cost. - Accurate seismic images allow more precise and

less environmentally destructive drilling.

9

Seitel (SEI) Where Will Growth Come From?

- DDD Energy wholly owned exploration and

production subsidiary. - Cost and revenue sharing relationships with more

than 100 oil and gas companies. - Seitel supplies the seismic data and other

location assistance and shares (average 31) in

revenues from any oil and gas finds. - Seitel has already provided these services to

locate wells that will be drilled during the next

3 years. - From March 1993 to 2000, participated in drilling

of 325 wells, 224 of which were commercially

productive, a 69 success rate.

10

SEI vs Oil Field Equipment and Services vs SP(3

years)

11

SEI vs Oil Field Equipment and Services vs SP (1

year)

12

Bold black numbers are from Value Line,Red

underlined numbers are estimates from Zacks,

Blue italic numbers are my calculations (Graphs

follow).

13

Growth Rates () per Share EPS, Revenue, CF (My

calculations based on Value Line numbers.)

14

Competitors

- Petroleum Geo Service (PGO)

- Acquiring, processing, and marketing seismic

data. - Providing floating production, storage and

overloading (FPSO) vessels. - Providing other services that help oil and gas

companies monitor producing oil and gas

reservoirs to increase ultimate recoveries. - Veritas DGC (VTS)

- Provider of integrated seismic and geophysical

technologies to the petroleum industry worldwide.

15

Seitel (SEI) and 2 Largest Competitors

16

SEI vs Two Largest Competitors vs SP500 (3 years)

17

SEI vs Two Largest Competitors vs SP500 (1 year)

18

Revenue vs Competitors (Quicken)

Revenue vs competitors ( in millions)

19

Net Income vs Competitors (Quicken)

Net Income vs competitors ( in millions)

20

ROE () vs Competitors

ROE Comparison with competitors

21

Net Profit Margins () vs Competitors (MSN)

22

Net Margin vs Oil Gas Equipment/Services

Industry (Quicken)

23

Ratio Comparisons (Yahoo)Industry Oil Well

Services and Equipment

24

PE Ratio Comparisons (Yahoo)Industry Oil Well

Services and Equipment. Sector Energy.

25

History of Crude Oil Prices

26

SEI Historic P/E (Green)

PE Comparison with competitors

27

2001 Intrinsic Value P/E Valuation Method

- Justified P/EEPS1. (FY ends in December)

- Present PE (10.2) is at low end of 5 year range.

- Half the PE of seismic peers.

- For EPS1 estimates

- High 1.16, Low 1.14, Average 1.15

- Best Case (2001) 101.16 11.6

- Worst Case (2001) 51.14 5.70

- Most Likely (2001) 71.15 8.05

- Current Price 8.88/sh

28

2002 Intrinsic ValueP/E Valuation Method

- Justified P/EEPS2. (FY ends in December)

- Present PE 10.2

- EPS2 estimates

- High1.76, Average 1.60, Low 1.35.

- Best Case (2002) 121.60 19.2

- Worst Case (2002) 6 1.20 7.2

- Most Likely (2002) 81.35 10.8

- Current Price 8.88/sh

29

Risks

- Steep decline in energy prices would be a big

problem. - Risk that world energy prices could collapse.

- Over last 6 months, 7 insiders have sold 3.3 of

insider shares. No insider buys.

30

Discussion

- Unknown how would US War on terrorists affect

oil and gas industry? Price up or down? - All energy stocks hurt due to huge decrease in

demand? - War causes higher energy prices?

- National security issue domestic energy

emphasis? - Bush administration support for domestic energy?

- Will OPEC cut back on supply to keep prices up if

world demand plunges?

31

Oil A National Security Issue?

- Will drilling in US increase because energy is

considered to be a national security issue. - Oil embargos has been used as a weapon against

USA in the past. Imported oil accounted for 35

of USA needs in 1973 and more than 50 now. And

this was after the Arab oil embargo in 1973 that

triggered a USA recession. - The main reason we did not try harder to take out

terrorists in the past is due to fear of bad

relations with our Middle East oil suppliers. - Should we continue to rely on the fragile long

line of oil tankers that come from an unstable

Middle East (20 of our oil imports come from

the Persian Gulf). - The Bush administrations energy plan focuses on

increasing the share of our energy needs that

come from the US. - New military build up will require increased

amounts of oil. - Previously, wars in Middle East caused oil prices

to increase.

32

Oil Futures

33

Natural Gas Futures

34

Recommendation

- Wait a while and see what happens with energy

prices. - I perceive more downside risk at this time. Might

be worth the risk if SEI goes below 8. - Top oil analyst when the OSX hits the 50s (now

59, down from record high 140), the sector will

be at rock-bottom and be an excellent time to

buy, especially given that stocks will be out of

favor with the street. These will be good 6 to 12

month bets. - Aside silver lining for collapse in energy

prices. Hurts the energy industry, helps other

industries?. Would put extra money into consumer

pocketbooks.