RATIONAL ACTORS, TCA, P - PowerPoint PPT Presentation

Title:

RATIONAL ACTORS, TCA, P

Description:

RATIONAL ACTORS, TCA, P&A Most economists rigorously defend the rational actor model of decision making, but others seek to modify assumptions to induce greater realism. – PowerPoint PPT presentation

Number of Views:151

Avg rating:3.0/5.0

Title: RATIONAL ACTORS, TCA, P

1

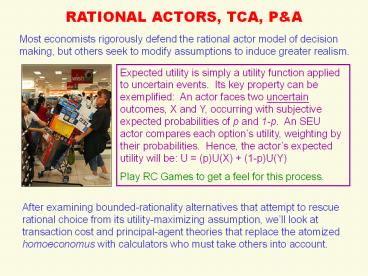

RATIONAL ACTORS, TCA, PA

Most economists rigorously defend the rational

actor model of decision making, but others seek

to modify assumptions to induce greater realism.

Expected utility is simply a utility function

applied to uncertain events. Its key property

can be exemplified An actor faces two uncertain

outcomes, X and Y, occurring with subjective

expected probabilities of p and 1-p. An SEU

actor compares each options utility, weighting

by their probabilities. Hence, the actors

expected utility will be U (p)U(X)

(1-p)U(Y) Play RC Games to get a feel for this

process.

After examining bounded-rationality alternatives

that attempt to rescue rational choice from its

utility-maximizing assumption, well look at

transaction cost and principal-agent theories

that replace the atomized homoeconomus with

calculators who must take others into account.

2

Rational Choice Games

Makes a rational choice for each pair of bets

i.e., choose that bet which will maximize your

subjective expected utility U (p)U(X)

(1-p)U(Y)

Problem 2 Choose between (C) Certainty of

receiving 100 (D) 10 chance of winning 500

and 90 chance of winning 100

- Problem 1 Choose between

- 10 chance of winning 100 and

- 90 chance of nothing

- (B) 10 chance of winning 500 and

- 90 chance of nothing

Problem 3 Choose between (E) Certainty of

receiving 100 (F) 50 chance of winning 200 and

50 chance of winning nothing

Problem 4 Choose between (G) Sure loss of

100 (H) 50 chance of losing 200 and 50

chance of losing nothing

3

Milton Friedman, As If

In The Methodology of Positive Economics

(1953), Milton Friedman defended the allegedly

unrealistic assumptions of rational choice

model.

He argued that people and firms make decisions

as if they apply SEU maximization under perfect

information. Economic theory has great

predictive value despite its obvious

unrealistic assumptions. Whether firms really

seek to maximize profits is irrelevant the only

important theoretical criterion is that it

generates correct and significant predictions.

It is frequently convenient to present such a

hypothesis by stating that the phenomena it is

desired to predict behave in the world of

observation as if they occurred in a hypothetical

and highly simplified world containing only the

forces that the hypothesis asserts to be

important. In general, there is more than one way

to formulate such a description more than one

set of assumptions in terms of which the theory

can be presented. The choice among such

alternative assumptions is made on the grounds of

the resulting economy, clarity, and precision in

presenting the hypothesis their capacity to

bring indirect evidence to bear on the validity

of the hypothesis by suggesting some of its

implications that can be readily checked with

observation or by bringing out its connection

with other hypotheses dealing with related

phenomena and similar considerations.

4

Simon Says, Bounded Rationality

The polymath Herbert Simon proposed that

rationality is bounded. Because getting

information is costly and decision outcomes

typically unknown, instead of maximizing

utilities, people only try to satisfice.

Satisficing behavior seeks only a minimum, not a

maximum value of a variable people choose as

well as they think is possible. The behavioral

theory of the firm sees producers treating

profits as constraints, not goals to be

maximized. Although some critical level of

profit must be achieved, thereafter, a firms

priority turns to its other goals.

Most producers are employees, not owners of the

firms..... Viewed from the vantage point of

classical economic theory, they have no reason

to maximize the profits of the firms, except to

the extent that they can be controlled by

owners.... there is no difference, in this

respect, among profit-making firms, nonprofit,

and bureaucratic organizations. All have exactly

the same problem of inducing their employees to

work toward the orgl goals. There is no reason,

a priori, why it should be easier (or harder) to

produce this motivation in organizations aimed at

maximizing profits than in organizations with

different goals. The conclusion that

organization motivated by profits will be more

efficient than other organizations does not

follow the organizational economy from

neoclassical assumptions. If it is empirically

true, other axioms will have to be introduced to

account for it.

5

Prospecting for Gains Losses

Daniel Kahneman Amos Tverskys prospect theory

posited a gain-loss cognitive process that guide

behaviors under conditions of uncertainty.

Using lottery choices as a paradigm, they divided

behavioral decision making into two phases (1)

Editing events into a mental model, which orders

alternatives by a simple heuristic, to

enable (2) Evaluation, which is asymmetric

losses have bigger impact than gains on choices

(risk-aversion)

- Prospect theory may offer better explanations

than the standard rational choice model of - Gambling betting puzzles we suffer more from

a loss than we enjoy a win - Endowment effect over-valuing something once

you own it (house, painting) - Status quo bias people prefer that things stay

relatively unchanged - Equity premium puzzle why are stock returns 6

gt govment bonds? - Intertemporal consumption personal savings are

highest in middle-age because people divide their

assets into mental accounts with different

consumption rates

Unlike additive utility functions of neoclassical

economics, prospect theory implies that personal

utilities can derive from social reference

groups. Happiness research finds that subjective

measures of well-being remain relatively stable

over time, despite large absolute increases in

living standards within a population (Easterlin

1974 Frank 1997).

6

Uncertainty as a Scope Condition?

Jens Beckerts (1996) criticized rational choice,

not for its unrealistic informational

requirements, but inability to explain how people

actually choose under conditions of uncertainty

(no info to assign probabilities).

The assumption of uncertainty threatening

the notion of rational choice as the core

behavioral assumption of economic theory.

Important to look at those cognitive,

structural, cultural mechanisms that agents

rely upon when determining their actions without

knowing what to do in order to maximize their

outcome.

- Should the scope condition of RCT be restricted

only to near-certain economic situations (i.e.,

perfect markets complete information)? - Give examples of social devices that actors can

use in uncertain conditions that limit the

choice set and make actions at the same time

predictable - Rules regulations (institutions)

- Social norms conventions

- Social structures

- Power relations

7

Transaction Cost Analysis

While still a grad student, Ronald Coase (The

Nature of the Firm 1937) posed two questions

that won him the 1991 Nobel Prize for economics

- Why do any firms emerge in a market economy,

instead of just individuals contracting each

other? - Why not just One Big Firm for the entire

economy, with all employees hired by a single

entrepreneur to produce everything?

Coase argued that markets arent cost-free, but

involve transaction costs time money to search

for sellers buyers, negotiate exchange terms,

write contracts, keep trade secrets, inspect

results, enforce deals.

Firms will emerge whenever an economizing

organization can reduce its production

transaction costs lt market prices Firm expansion

halts when intra-orgl TC gt market prices

8

The Costs of Transacting

Transactions are embedded within social,

political, legal institutional environments that

affect transaction costs. These rules of the

game affect property, production, distribution,

and exchange relations among economic actors.

EPA regulations about lead

pollution emissions

Opportunism Self-interest with guile could

induce strategic behavior by transactors to lie

to, cheat, confuse, mislead their exchange

partners Used car salesmen political

candidates your prelim study group?

Even if opportunism risks are low, actors must

still safeguard against possibly severe damages

from opportunistic partners (the worst-case

scenario). But, contracts cannot be iron-clad

against all possible contingencies that may

arise! What to do?

9

Transaction Economizing ? Governance

Oliver Williamson identified three forms for

governing transactions conditions where each

governance form more likely to be used.

Market Transactions governed by prices in

supply-demand equilibrium Hierarchy (Formal org)

Transactions among parties occur under one owner,

who settles disputes by administrative

fiat Hybrid Long-term contractual relations

that preserve parties autonomy, but provide

added transaction-specific safeguards as compared

with the market.

- Orgs hybrids likely to internalize transactions

(make-not-buy) if - Frequency of exchanges is high, not a one-off

occurrence - Uncertainty about environments/actors is high

e.g., hurricanes floods often delay

just-in-time delivery from your suppliers

factory - Asset specificity is high, i.e., investments in

human skills, brand names, sites, machinery

lacking other uses e.g., a blast furnace that

produces a type quality of steel demanded by

just a few customers

10

Williamsons discriminating alignment hypothesis.

Transactions of varying attributes align with

governances structures differing in cost and

competence, so as to effect a (mainly)

transaction cost economizing result (199837).

Public bureau is the form of last resort.

11

Principal-Agent Theory

Principal-agent theory of contracts shares with

TCA core concepts of uncertainty, opportunism,

externalization, cost-efficiency calculations.

Principal pays Agent to perform service in

exchange for fee

? Stars hire Hollywood, sports agents to

negotiate contracts (Jerry McGuire) ? Board of

directors pays white-knight CEO megabuck to

boost share prices ? Trustees search for a

university president to raise its academic

prestige

- Information asymmetry How does Principal know

if Agent is competent and working on behalf of

Ps interests? (If P had necessary knowledge and

skills, then As services would be unnecessary) - Agency costs Principals costs to search,

monitor, bond in hiring and supervising the

Agent (vs P doing the job all by herself) - Opportunism moral hazard Risk-averse Agent is

tempted to deceive shirk duties to pocket fee

but not deliver the best deal

12

Moral Hazards

Moral hazard is the risk that one party to a

contract can change its behavior to the detriment

of the other party after the contract is signed.

- Insurance can encourage riskier behaviors

- Avoid preventive medical, dental check-ups

- Fail to clear brush near California homes

- Incentives to commit arson of failing business

- Bankruptcy laws foster foolish consumption

- Does available abortion promote promiscuity?

To lessen hazards, actuaries wont insure any

property for more than it is worth, or even for

its replacement cost, and almost always require a

deductible (initial up-front sum which the

insured must pay out of his or her own pocket).

They may also impose other conditions, such as

the ownership of fire extinguishers.

A common solution to moral hazard problems

closely related to information asymmetry is to

offer appropriate incentives that will induce

agents act in behalf of the principals

interests.

13

Performance Incentives

Monitoring Agents skills activities is

difficult, so Principal could use

pay-for-performance incentives to encourage As

risk-taking and make A more accountable in

looking out for Ps interests

Make As compenation contingent on actual

outcomes CEO bonus, stock options depend on

annual share prices Teachers salary gains tied

to her students test scores

Problem Orgs performance affected by many

factors beyond agents control (fickle consumers,

govt regs, bad weather) In high uncertainty,

tying compensation to performance may actually

induce a risk-averse CEO to take timid,

less-risky actions in effort to avoid a major

loss to personal fortune

Major corporate CEO pay-performance effect very

weak only 3.25 per 1,000 change in

shareholder wealth 1 weeks pay (9,600 in

1980s) This amount judged small for an

occupation in which incentive pay is expected to

play an important role (Jensen Murphy 1990227)

14

Readings Discussion Quex

1. Does Williamsons TCA theory over-emphasize

the risks from potential opportunism? Why should

actors strive mightily to safeguard against

deceit, when most transacting partners can be

expected to behave honestly? 2. By recognizing

the importance of economic institutions

especially governance structures does TCA plug

weaknesses in neoclassical RCT? 3. Williamson

There is no one, all-purpose, superior form of

organization a place needs to be made for each

generic form, but each form needs to be kept in

its place. Do you agree? What is the place of

public bureaucracies? 4. Eisenhardts P7 Goal

conflict between P A is negatively related to

behavioral contracts positively to

outcome-based contracts. Discuss an example of

P A with little disagreement on goals, leading

to outcome-based contracting. (HINT

Advisor-Grad student relations?) 5. Despite its

focus on cooperative tasks by actors with partial

goal conflicts, is agency theory still too

strongly wedded to economic rational actor

models? 6. How does Boudons propose to salvage

RCT for sociology? 7. Why does Boudon

characterize Webers interpretive sociology of

religion as not an RCT? Could it become RCT by

embracing additional postulates?