Two Liquidation Modes PowerPoint PPT Presentation

1 / 19

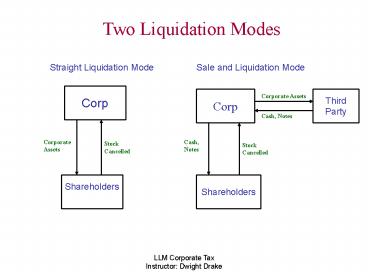

Title: Two Liquidation Modes

1

Two Liquidation Modes

Straight Liquidation Mode

Sale and Liquidation Mode

Corp

Corp

Third Party

Corporate Assets

Cash, Notes

Corporate Assets

Cash, Notes

Stock Cancelled

Stock Cancelled

Shareholders

Shareholders

2

Complete Liquidation Shareholder Impact

General Rule Per 331, complete liquidation

treated as sale or exchange of stock, producing

capital gain or loss equal to difference between

cash and FMV of property received and

shareholders basis in stock. Section 301 not

apply. Timing Issues - When did liquidation

began and dividends (non-liquidating)

distributions end. Fact question. Look to

corporate resolutions and adoption of plan. -

453 installment sales treatment applies when

liquidating distributions over time. Open

transaction treatment very risky appears trumped

by 453. - 453 installment treatment permitted

even as to installment obligations acquired by

non-public corp in asset sell-off and distributed

to shareholders. To qualify under 453, corp sale

that created obligation must be within 12 month

period after liquidation plan adopted and

liquidation must be completed within same period.

Inventory and dealer property qualify allowed

only if part of bulk sale of assets.

3

Complete Liquidation Corporation Impact

General Rule Per 336, Corp recognizes gain or

loss on property distributed or sold as part of

complete liquidation. 267 related-party loss

limitations not apply in complete liquidation.

(d)(1) Related Party Exception No loss at all

on distribution to related party (per 267) in

complete liquidation if - Distribution

not pro rata, or - Distributed property

acquired by corp in 351 transaction or as

contribution to capital within 5 yrs of

distribution (Disqualified Property). (d)(2)

Tax Avoidance Exception No built-in loss (loss

at time of acquisition) allowed if property

acquired in 351 transaction or contribution to

capital and principal purpose was to recognize

loss on liquidation. If acquired within 2 yrs of

plan of liquidation, bad purpose a done deal

unless there is clear and substantial

relationship between property and conduct of

business and solid explanation. If outside 2yr

window, probably safe except in most rare

cases.

4

Problem 331

- Basic Facts A owns 100 shares of HCorp, cost

10k. H Corp EP 12k. H Corp liquidates. - A gets 20k cash in liquidation. A has LTCG of

10k per 331(a). - A gets 10k yr 1 and 10k yr 2. Under 453, A

recognizes 5k LTCG in year 1 and 5k LTCG in year

2. Service allows open reporting if amount

uncertain if so, no gain until basis recovered.

Can elect to opt out of 453 then full 10k LTCG

in year 1. - If no plan a liquidation in year 1, may be

issue of whether both distributions are part of

liquidation (fact issue). If not, then year 1

distribution 10k ordinary income dividend under

301 yr 2 liquidating distribution and no gain.

5

Problem 331

- Basic Facts A owns 100 shares of h Corp, cost

10k. H Corp EP 12k. H Corp liquidates. - A gets in liquidation 8k cash and 12k note,

payable 1k per yr for 12 yrs. H obtained note on

sale of capital asset as part of liquidation. A

realizes 10k LTCG on sale. Per 453(h),

installment reporting available on note if

obtained by corp within 12 month period after

adoption of plan of liquidation and liquidation

completed in 12 months after plan. Gross profit

percentage is 50. Hence, 4k LTCG yr 1 on

receipt of 8k and .5k in each following year on

receipt of 1k. - If H stock publicly traded, 453(k)(2)(A)

precludes use of 453. 10k LTCG. - Same as (d), but installment obligation received

by H two yrs ago and no payments made. No hope

for installment reporting because obtained before

plan of liquidation. 10K LTCG in year 1 and

basis in note 12k. - After liquidation, A pays 5k judgment against old

H. Per Arrowsmith case, this 5k LTCL to A even

though would have been deductible to H Corp.

Character of loss determined with reference to

LTCG reported by A.

6

Problem 344

- Basic Facts X Corp stock owned by I (60) shares

and F (40 shares). No liabilities and following

assets. On 1/1, adopts plan of liquidation. -

Basis FMV - Gainacre 100k

400k - Lossacre 800k

400k - Cash

200k 200k - All assets distributed to I and F 60-40 pro-rata

as tenants-in-common. X Corp has 300k gain on

Gainacre and 400k loss on Lossacre. Shareholders

take basis equal to FMV per 334(a). 336(d) loss

limitation not apply because distribution pro

rata and assets held over 5 yrs. - I gets Lossacre and cash F gets Gainacre. X has

300k gain on Gainacre. Loss on Loassacre not

allowed per 336(d)(1) because I is related person

per 267 (more than 50) and distribution not pro

rata. Is basis in Lossacre still 400k loss in

permanently gone.

7

Problem 344

- Basic Facts X Corp stock owned by I (60) shares

and F (40 shares). No liabilities and following

assets. On 1/1, adopts plan of liquidation. -

Basis FMV - Gainacre 100k

400k - Lossacre 800k

400k - Cash

200k 200k - X distributes Gainacre and 200k to I and Lossacre

to F. X recognizes 300k on Gainacre and 400k

loss on Lossacre. Although not pro rata, F not

related person under 267 because not over 50

owner. Thus, 336(d) limit not apply. - (d) Same pro rata as (a), but X acquired

Lossacre 4 yrs ago as contribution to capital.

Still 300k gain on Gainacre. 60 portion to

Lossacre loss (240k) not allowed per 336(d)

because go to I and disqualified property

because acquired within 5 yrs in 351 transaction.

Loss on portion to F (160k) allowed. I and F

still take basis equal to FMV . Same result if

Lossacre has 1 mill FMV and 800k basis on

contribution to capital. For 336(d)(1) purposes,

built-in gain or loss not applicable.

8

Problem 344

- Basic Facts X Corp stock owned by I (60) shares

and F (40 shares). No liabilities and following

assets. On 1/1, adopts plan of liquidation. -

Basis FMV - Gainacre 100k

400k - Lossacre 800k

400k - Cash

200k 200k - Gainacre and cash to I Lossacre to F Lossacre

have no relationship to X business and acquired

by 351 transfer from I and F 18 months prior to

plan of liquidation when FMV 700k and basis 800k.

336(b)(1) disallowance not apply because F not

267 related party. But 336(b)(2) anti-stuffing

rule might apply because 351 transaction within 2

yrs of plan. If 362(e)(2) basis adjustment made

at contribution, no need for 336(b)(2)

anti-stuffing loss never realized. If no

336(e)(2) adjustment, then 100k pre-contribution

loss disallowed per 336(b)(2), but 300k

post-contribution loss allowed. No hope of

rebutting 2 yr taint presumption because asset

not related to X business.

9

Problem 344

- Basic Facts X Corp stock owned by I (60) shares

and F (40 shares). No liabilities and following

assets. On 1/1, adopts plan of liquidation. -

Basis FMV - Gainacre 100k

400k - Lossacre 800k

400k - Cash

200k 200k - I and F own X Corp 80-20. I contributed Gainacre

and Lossacre F contributed cash in 351 deal.

Lossacre is 336(d)(1) disqualified property,

362(e)(2) applied at contribution, 336(d)(2) not

apply because no plan for X to recognize loss

on liquidation. X distributes each asset

pro-rata to parties in liquidation. - - 362(e)(2) basis reduction is 100k

(900k less 800k) based on Is contibution of

assets. - - Of remaining 300k built-in loss on

Lossacre, 80 (240k) disallowed because I related

party. Remaining 20 (60k) allowed as loss to X.

10

Problem 344

- Basic Facts X Corp stock owned by I (60) shares

and F (40 shares). No liabilities and following

assets. On 1/1, adopts plan of liquidation. -

Basis FMV - Gainacre 100k

400k - Lossacre 800k

400k - Cash

200k 200k - (g) Same as (f), but there was plan to have X

recognize built-in loss. Then entire built-in

loss disallowed per 336(d)(2). Fact that portion

of Lossacre went to F (20 shareholder)

irrelevant.

11

Subsidiary Liquidation

Impacts of qualifying as 332 subsidiary

liquidation - No gain or loss recognized by

parent corp per 332. - Parent corp takes

transferred basis in Subs assets per 334(b)(1).

- Parent corp inherits Subs EP and other tax

attributes (pro rata) per 381(a)(1). - No gain

or loss to Sub corp per 337, which overrides

1245, to extent distributions to 80-percent

distributee. - No relief to minority

shareholders liquidation gain recognized and

basis FMV. - Loss assets to satisfy Parent corp

debt not trigger loss per 337(b)(1). - No 337

relief if tax exempt owns stock. 337(b)(2).

12

Qualification Under 332

- Requirements

- Plan of complete liquidation adopted.

- 80 of total of Sub voting stock owned by

corporate parent from adoption of plan until

liquidation. - 80 of total value of Sub stock owned by

corporate parent from adoption of plan until

liquidation. - Timing either

- - One-shot liquidation within one taxable

year. - - Plan provides competed within 3 years

after year of first distribution.

13

Problem 356-1

- Basic Facts P Inc. (P) owns 90 X Corp stock

I owns 10. P basis 3k I basis .2k. X EP 2k.

Following X assets -

Basis FMV - Land

3,000 8,000 - Equip

2,500 1,000 - Inventory

100 1,000 - Liquidation scenarios

- Inventory to I other assets to P.

- - 332 requirements all met Both 80

tests one-shot liquidation that meets timing

requirements of 332(b)(2). - - P recognizes none of 6k (9k less 3k

basis) gain recognized. - - I (10 individual) recognizes 900 gain

(1k less 100 basis) - - I basis in inventory 1k.

14

Problem 356-1

- Basic Facts P Inc. (P) owns 90 X Corp stock

I owns 10. P basis 3k I basis .2k. X EP 2k.

Following X assets -

Basis FMV - Land

3,000 8,000 - Equip

2,500 1,000 - Inventory

100 1,000 - Liquidation scenarios

- Inventory to I other assets to P (Continued).

- - P basis in land 3k, equip 2.5k both

carryover per 334(b)(1). P stock basis

disappears. - - X has 900 gain on inventory. No gain or

loss on other assets because P 80-percent

distributee per 337(c). - - P picks up Xs tax attributes per 381

and 90 EP. X EP is 2k plus .9k on inventory

distribution for 2.9k total. Thus Ps EP goes

up 2.61k (90).

15

Problem 356-1

- Basic Facts P Inc. (P) owns 90 X Corp stock

I owns 10. P basis 3k I basis .2k. X EP 2k.

Following X assets -

Basis FMV - Land

3,000 8,000 - Equip

2,500 1,000 - Inventory

100 1,000 - Liquidation scenarios

- Equipment to I other assets to P. Same result

as in (a) except no inventory gain to X, and EP

carryover gain to P is 1.8k (90 of 2k). No loss

recognition to X on 332 liquidation per

336(d)(3). Improve by transferring loss

equipment to P or selling loss equipment. If

336(d)(2) not apply to sale, 1.5k loss recognized

by X and transferred EP reduced to 450 (90 of

500). - Smart to sell loss asset if possible.

Note, I basis in equipment 1k (step-down basis

loss).

16

Problem 356-1

- Basic Facts P Inc. (P) owns 90 X Corp stock

I owns 10. P basis 3k I basis .2k. X EP 2k.

Following X assets -

Basis FMV - Land

3,000 8,000 - Equip

2,500 1,000 - Inventory

100 1,000 - Liquidation scenarios

- Same as (b), but P basis in S stock 30k and X

basis in land. P recognizes no loss X

recognizes no loss. Land 30k basis carries over

to P per 334(b)(1). I still has step down 1k

basis in equipment and 800 gain. EP carryover

to P still 1.8k. - If flunk 332, P gets loss on stock. X still

wont get loss because of 336(d)(1)(A) (P owns

over 50). Two ways to flunk. P sells off over

20 stock per Day Zimmerman case. Or X

stretches liquidation over 3 yr. period. Also, X

could sell loss asset and recognize loss

(smartest).

17

Problem 356-2

- Basic Facts C Corp 100 shares out. M Corp

owns 75 shares (basis 1k) U owns 25 shares

(basis 3k). C has no EP 10k NOL following

assets -

Basis FMV - Cash

2,000 2,000 - Note

1,000 4,000 - Land

100 1,000 - Equip

100 1,000 - Total

3,200 8,000 - (a) C liquidates 2k cash to U rest to M. No

332 because no 80. M has 5k gain (6k less basis

of 1k). U has 1k loss (2k less 3k basis). C has

3k gain on note, .8k gain on equip, all offset by

NOL carryover. No carryover attributes to M. M

and U have basis equal to FMV of assets received

per 334(a).

18

Problem 356-2

- Basic Facts C Corp 100 shares out. M Corp

owns 75 shares (basis 1k) U owns 25 shares

(basis 3k). C has no EP 10k NOL following

assets -

Basis FMV - Cash

2,000 2,000 - Note

1,000 4,000 - Land

100 1,000 - Equip

100 1,000 - Total

3,200 8,000 - 2k to redeem U stock. Complete liquidation of C

one week later. If 332 apply, M have no gain, C

has no gain, no gain on installment note per

453B(d), no 1245 gain to C per 1245(b)(3), full

10k NOL carries over to M. No EP to carry over. - Will 332 apply? Not per Rev. Rule 70-106 if

prearranged and plan adopted before redemption

(likely here). But see Riggs case much room to

plan.

19

Problem 356-3

Basic Facts P Corp own all stock of S Corp and

holds bonds at face and book value of 1k. Before

332 liquidation, S corp distributes inventory

with 10k basis and 1k fair market value to retire

debt. Objective To recognize 9k loss before 332

liquidation. Result No hope. Step transaction

will kill. Note, P corp does pick up 10k basis

in inventory per 334(b)(1).