Republic of Cyprus - PowerPoint PPT Presentation

1 / 29

Title:

Republic of Cyprus

Description:

Frequently Asked Questions 1. Which are Cyprus's competitive advantages? 2. Can EU and non-EU nationals register a company in Cyprus and what is the minimum capital ... – PowerPoint PPT presentation

Number of Views:115

Avg rating:3.0/5.0

Title: Republic of Cyprus

1

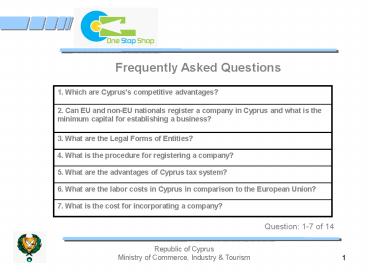

Frequently Asked Questions

1. Which are Cyprus's competitive advantages?

2. Can EU and non-EU nationals register a company in Cyprus and what is the minimum capital for establishing a business?

3. What are the Legal Forms of Entities?

4. What is the procedure for registering a company?

5. What are the advantages of Cyprus tax system?

6. What are the labor costs in Cyprus in comparison to the European Union?

7. What is the cost for incorporating a company?

Question 1-7 of 14

2

Frequently Asked Questions

8. What is the procedure for obtaining a work permit?

9. How many third country nationals can a company employ?

10. What are the figures of FDI inflow during the last years?

11. Give some examples of foreign companies that have invested in Cyprus.

12. What measures have been taken by the Government in order to encourage more FDI investment?

13. What are the main sources of FDI inflows?

14. What are the main changes since Cyprus's accession to the EU?

Question 7 -14 of 14

3

1) Which are Cyprus's competitive advantages?

- Cyprus offers a unique basket of advantages to

foreign investors utilizing Cyprus as a base for

conducting their business activities worldwide.

Its competitive advantages derive from - Strategic geographical location

- Favourable business climate

- Fiscal regime

- Stable macroeconomic environment

4

Which are Cyprus's competitive advantages?

- High educational level of the labour force in

conjunction with the comparatively low level of

graduates remuneration - Modern legal, banking and financing systems

- Excellent infrastructure with advanced transport

and telecommunications network - Ease of communication

5

2) Can EU and non-EU nationals register a company

in Cyprus and what is the minimum capital for

establishing a company?

In order to enhance further the foreign

investment intensity, the Cyprus Government has

fully liberalized the Foreign Direct Investment

(FDI) policy. Thus, EU nationals as non-EU

nationals have the same right to establish a

company in Cyprus since foreigners participation

percentage limitation has been abolished.

Notably, there is no minimum share capital.

6

3) What are the Legal Forms of Entities?

Foreign investors may establish any of the

following legal entities in Cyprus by registering

at the Department of the Registrar of Companies

and Official Receiver in Nicosia

- Companies (private or public)

- General or limited partnerships

- European Company (SE)

- Branches

7

4) What is the procedure for registering a

company?

- The procedure for registering a company in Cyprus

is fast and straightforward - Initially, an application for the approval of

the legal entitys name is submitted. - After securing the legal entity's name, the

relevant documents for the legal entitys

registration (i.e. Memorandum of Understanding,

Articles of Association, etc.) are to be

submitted depending on the type of the legal form

of the entity.

8

What is the procedure for registering a

company?

- In the case of registering a company (private or

public) the documents are to be submitted through

an advocate / lawyer practicing in Cyprus. - Note For a complete list of lawyers, visit the

Cyprus Bar Association's website

(www.cyprusbarassociation.org).

9

5) What are the advantages of Cyprus tax system?

- Cyprus tax system has been reformed to comply

with the EU Acquis Communautaire, the appropriate

actions have taken place to maintain Cyprus

competitiveness as an international business

centre and enhance its attractiveness as a

suitable jurisdiction for holding companies. - Corporate Tax All companies are subject to a

uniform tax rate of 10, the lowest tax rate in

the European Union. - Personal Income Tax Based on the Eurostats

statistics Cyprus does not only exhibit the

lowest corporate tax rate, but also one of the

lowest top statutory personal income tax rate at

30

10

What are the advantages of Cyprus tax system?

- Double taxation agreements Cyprus has developed

a wide network of Double Tax Agreements with over

40 countries, ensuring that the same income is

not taxed twice - Special Tax treatment Cyprus is considered as

one of the most competitive shipping centers in

the world in terms of registration fees and

taxes. - Value Added Tax Value added tax rate is imposed

on the supplies of goods and services as well as

on the imports to Cyprus. The standard rate of

15 applies to Cyprus, the lowest rate permitted

in the EU

11

6) What are the labor costs in Cyprus in

comparison to the European Union?

- The labour costs in Cyprus are significantly

lower compared to the European Union average.

Specifically, the average hourly labour costs,

based on Eurostat Yearbook 2008, of Cyprus was

11.98 while that of EU27 was 20.35 while,

within the structure of the labour costs, Cyprus

exhibits one of the lowest shares of social

security costs paid by the employer. - It is worth mentioning that, based on Eurostat

statistics 2007, Cyprus was among the leading

member states exhibiting a labour productivity in

all high-tech sectors above the EU-25 average and

a total personnel costs per person employed below

the EU-25 average.

12

7) What is the cost for incorporating a company ?

Type of Company Fee in

Name Approval 8,54 Normal Procedure 25,36 Accelerated procedure

Registration of a limited liability company by shares or guarantee, with share capital 102,52 plus 0.6 subscription tax on nominal capital 187,95 Accelerated procedure

Registration of a limited liability company by shares or guarantee, without share capital 170,86 Normal Procedure 256,29 Accelerated Procedure

13

What is the cost for incorporating a company ?

Type of Company Fee in

Application for registration of a general or a limited partnership 102,52 Normal Procedure 136,69 Accelerated Procedure

Application for registration of a Brach 256,29 Normal Procedure 341,72 Accelerated Procedure

Application for registration of a Business Name 68,34 Normal Procedure 102,51 Accelerated Procedure

14

8) What is the procedure for obtaining a work

permit?

Third country nationals and all companies of

foreign interest wishing to register a company in

Cyprus and employ other third country nationals

need to obtain a residence and employment permit

by the Civil Registry and Migration Department.

Some of the most important requirements they need

to fulfill are the following

1. The majority of the companys shareholders

should be foreign shareholders and in the case of

shareholders whose ultimate owners are foreign

companies, they should be declared in order to be

approved by the Civil Registry and Migration

Department (CRMD).

15

What is the procedure for obtaining a work

permit?

- 2. In case where the percentage of foreign

participation in the share capital of a company

is equal or below fifty percent (50) of the

total share capital, this percentage should

represent an amount equal or higher than 171.000

in order for a company to be considered eligible.

16

9) How many third country nationals can a company

employ?

Eligible companies which fulfill the above

conditions may employ third country nationals in

the following positions. Companies should not

commit themselves to employing third country

nationals for all the following positions before

securing a Temporary Residence and Employment

Permit from the Civil Registry and Migration

Department (CRMD) A) Executive Directors B)

Middle Management Staff C) Supportive Staff

17

- Executive Directors

- The term Executive Directors includes third

country nationals registered as - Consulting Directors or Partners (in the

Registrar of Companies) - General Managers of branches and subsidiary

foreign companies - Departmental Managers

18

- Executive Directors

- The maximum number of such executives is five (5)

unless the CRMD is persuaded that a greater

number is justified. - The minimum acceptable total annual salary

(annual salary plus any additional

allowances/benefits) for a newly appointed

Executive Director is 41.000. This amount may be

adjusted from time to time according to

fluctuations in the salary index.

19

- Middle-management staff, executive staff and any

other key personnel - The abovementioned staff includes Directors who

are not considered to be Executive Directors as

well as other Executive/Middle-management staff

or other managerial, clerical or technical

personnel with an annual salary ranging from

20.503 to 40.999. The amounts may be adjusted

from time to time according to fluctuations in

the salary index.

20

- Middle-management staff, executive staff and any

other key personnel - The maximum number of employees permitted in this

category is 10. The CRMD has the discrete

authority to decide on the employment of more

than 10 people if justified, depending on each

companys operation data. In the case that the

total maximum number is exceeded, the company

should justify the necessity of the employment of

third country nationals, taking into

consideration the payments as well.

21

- C) Supporting Staff

- All third country nationals employed in other

professional, managerial, technical, clerical

etc. positions in Cyprus and do not fall under

the abovementioned categories (a) and (b), are

classified in the remaining supporting staff. - - Companies are expected to employ Cypriots or

European citizens for this category. In case that

there are not available or suitable Cypriots or

European citizens with the required

qualifications, a company may employ third

country nationals in positions of this category.

22

10) What are the figures of FDI inflow during the

last years?

- Cyprus ranks among the front runners of the world

according to the latest UNCTAD "World Investment

Report 2008", indicating both high FDI

performance and high FDI potential. - Notably, Cyprus has moved upwards in 2007 and

ranks among the top 20 rankings for inward FDI

performance whereas, as per the outward FDI

performance index it ranks as the 21st top in the

world. - The FDI inflows for 2007 were above 2 billion

dollars continuing an upward trend for fourth

consecutive year, while showing an increase in

the range of 75 from year 2005 indicating the

country's attractiveness as an international

investment and business centre.

23

11) Give some examples of foreign companies that

have invested in Cyprus?

Some examples of foreign investments taking place

in the recent years in Cyprus is ?

Kommunalkredit International Bank Limited ?

Austria (Banking sector) ? Neptune Marine Oil

Gas Limited ? Norway (Drilling contractor

specialized on drill ships) ? Aer Rianta

International ? Ireland (PW, utilities ,

logistics), Intracom Holdings Ltd ? Greece

(Telecommunications, information technology) ?

Carrefour ? France (Retail), International Air

Charter plc ? UK head office (Aerospace sector) ?

Bank of Beirut ? Lebanon (Financial services),

Starbucks ? USA (Restaurant) ? GFI ? UK (IT

software)

24

12) What measures have been taken by the

Government in order to encourage more FDI

investment?

- The Ministry of Commerce, Industry and Tourism by

realizing the importance of FDI it has

demonstrated a clear and unequivocal commitment

to investment promotion, attraction, facilitation

and support by - Liberalizing the FDI Policy

- Reforming the favorable tax regime

- Establishing the Cyprus Investment Promotion

Agency - Establishing the One Stop-Shop

25

What measures have been taken by the Government

in order to encourage more FDI investment?

- In order to encourage FDI, the Government

- Is planning to establish by the end of 2009 the

Point of Single Contact - Provides to the investors investment incentives

- Undertakes the responsibility of accelerating

the Licensing Procedures related to the

realization of investments

26

13) What are the main sources of FDI inflows?

- The leading sources of FDI inflows to Cyprus in

2007 were from the European countries (95.38)

out of which 64 were from EU-25. - Over the years 1997 to 2007, the FDI inflows to

Cyprus from European countries, on average,

corresponded to 84.4 of the total FDI inflows. - Meanwhile, the top sources, of inward

investments to Cyprus for the year 2007, by

country, were United Kingdom, Russian Federation

and Netherlands while that of 2006 were United

Arab Emirates, Russian Federation and Greece.

27

14) What are the main changes since Cyprus's

accession to the EU?

- The accession to the EU has confirmed Cyprus

position as an important player in the European

and Middle East region, and reaffirmed its

potential as a rapidly developing market. - Remarkably, ever since Cyprus accession to EU,

the total number of FDI investments to Cyprus has

shown a continuous upward trend the total FDIs

for the year 2007 was double that of 2003

(increase in the range of 101).

28

- What are the main changes since Cyprus

accession to the EU? - The Euro provides long term opportunities for

further increase of foreign direct investments

due to, among others, the enhancement of

macroeconomic stability and investors confidence,

the reduced transactions costs i.e. for exports

and imports, the elimination of the exchange

risk, the anticipated lower interest rates that

will lead to lower cost of financing

29

- What are the main changes since Cyprus

accession to the EU? - The first year since adoption of Euro has proven

to be successful for Cyprus. The Government has

achieved a smooth transition from the Cyprus

pound to the Euro. It is estimated that the euro

currently contributes towards the safeguarding of

Cypruss healthy macroeconomic framework against

the possible impacts of a global economic crisis - In parallel, joining the EU and euro zone

positively affected the tourist industry and have

facilitated the boosting of trips between Cyprus

and the European Union countries